2025 EPA Emissions Standards: Impact on US Auto Manufacturing Costs

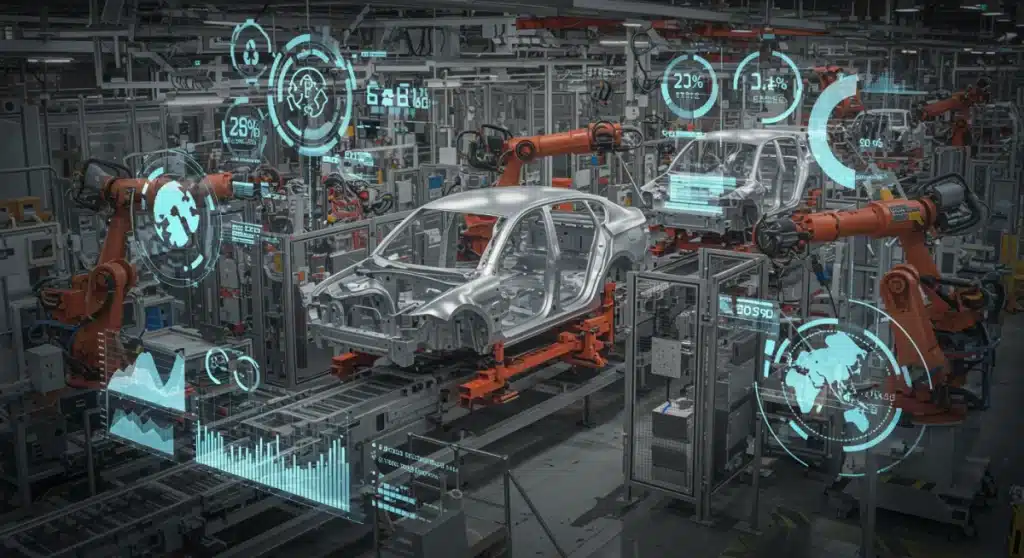

New 2025 EPA emissions standards are projected to increase US auto manufacturing costs by 10%, significantly impacting vehicle production, pricing, and strategic shifts towards cleaner technologies.

Breaking news reveals that new 2025 EPA emissions standards will impact US auto manufacturing costs by 10%, a significant shift for an industry already navigating complex economic headwinds. This impending regulatory change is set to reshape production strategies, vehicle pricing, and the overall trajectory of automotive innovation across the United States.

Understanding the New 2025 EPA Emissions Standards

The Environmental Protection Agency (EPA) has recently finalized stringent new emissions standards for model years 2027 through 2032, building upon the framework that begins in 2025. These regulations aim to drastically reduce greenhouse gas emissions from light-duty vehicles, pushing manufacturers towards a more sustainable, electric future. The 2025 standards serve as an initial, critical phase in this broader push.

These updated rules are a cornerstone of the Biden administration’s climate agenda, targeting a substantial reduction in tailpipe pollution. For automakers, this means a rapid acceleration in the development and deployment of zero-emission vehicles, particularly electric vehicles (EVs), to meet fleet-wide average emission targets. The standards are designed to be technology-forcing, compelling the industry to innovate at an unprecedented pace.

Key Components of the Regulations

The new standards introduce lower permissible emission levels for carbon dioxide (CO2), non-methane organic gases (NMOG), and nitrogen oxides (NOx). These targets become progressively stricter with each model year, beginning in 2025. Automakers will face penalties if their fleet averages exceed these limits, creating a powerful incentive for compliance.

- Fleet-wide Averages: Manufacturers must achieve specific average emission levels across their entire vehicle lineup, not just individual models.

- Credit System: A complex credit system allows automakers to earn and trade credits for exceeding standards, particularly with EV sales, offering some flexibility.

- Technology Acceleration: The rules are explicitly designed to drive the adoption of advanced emission control technologies and increase EV market penetration.

Projected 10% Increase in Manufacturing Costs

Industry analysts and automotive executives are projecting an average 10% increase in US auto manufacturing costs directly attributable to the new 2025 EPA emissions standards. This figure, while an average, encompasses a wide range of investments and operational adjustments that automakers must undertake to comply with the stricter regulations. The impact is multifaceted, affecting everything from research and development to supply chain logistics and factory retooling.

The primary drivers of this cost increase include the significant capital expenditure required for developing and producing more electric and hybrid vehicles, as well as enhancing traditional internal combustion engine (ICE) technology. Companies must invest heavily in new battery technologies, charging infrastructure development, and the re-skilling of their workforce. The shift is not merely about producing different cars but fundamentally transforming how cars are designed, built, and powered.

Factors Driving the Cost Escalation

Several key areas contribute to the projected 10% cost increase. Each presents unique challenges and requires substantial financial commitment from manufacturers.

- EV Battery Production: Scaling up battery production, securing raw materials, and developing more efficient battery packs are capital-intensive endeavors.

- Advanced Powertrain R&D: Significant investment in research and development for next-generation electric powertrains and more efficient ICEs is essential.

- Factory Retooling: Existing assembly lines must be reconfigured or entirely rebuilt to accommodate EV production, demanding substantial upfront costs.

Impact on Vehicle Pricing and Consumer Choices

The projected 10% increase in manufacturing costs is highly likely to translate into higher vehicle prices for consumers. Automakers historically pass a significant portion of their production costs onto buyers, and this situation is expected to be no different. This could potentially slow the adoption of new, cleaner vehicles, especially if federal incentives do not adequately offset the price hikes.

Consumers may face difficult choices between more expensive, compliant new vehicles and older, potentially less efficient, used cars. The affordability of new vehicles, particularly EVs, remains a critical factor in market adoption. This pricing dynamic could create a two-tiered market, where access to the latest, environmentally friendly technology is limited to those who can afford the premium.

Market Dynamics and Affordability Concerns

The automotive market is sensitive to price changes, and a 10% increase could shift consumer preferences. While some buyers are willing to pay a premium for environmental benefits or advanced technology, a broad market adoption requires competitive pricing. The challenge for manufacturers will be to innovate efficiently enough to mitigate these cost increases without compromising vehicle quality or safety.

Furthermore, the availability of charging infrastructure and the range anxiety associated with EVs continue to influence consumer decisions. Higher upfront costs for EVs, even with long-term fuel savings, can be a barrier for many households. Policymakers and industry leaders are actively discussing strategies to address these affordability concerns, including expanding tax credits and promoting infrastructure development.

Automaker Strategies for Compliance and Cost Mitigation

In response to the new 2025 EPA emissions standards and the anticipated cost increases, US automakers are rapidly deploying a range of strategies aimed at compliance and cost mitigation. These strategies are comprehensive, touching upon product development, manufacturing processes, supply chain management, and market positioning. The goal is to meet regulatory requirements while minimizing the financial burden on the company and, ultimately, the consumer.

Many manufacturers are accelerating their investment in electric vehicle platforms, aiming to achieve economies of scale more quickly. This involves standardizing components, collaborating with battery suppliers, and streamlining production lines. Diversification of their product portfolio, including a mix of highly efficient internal combustion engine vehicles, hybrids, and EVs, is also a common approach to meet fleet-wide averages effectively.

Key Strategic Adjustments

- Platform Electrification: Developing modular EV platforms that can underpin multiple vehicle models to reduce individual development costs.

- Supply Chain Optimization: Securing long-term contracts for critical raw materials like lithium and cobalt to stabilize battery production costs.

- Technological Innovation: Investing in advanced materials and manufacturing techniques to make lighter, more efficient vehicles, regardless of powertrain type.

- Strategic Partnerships: Forming alliances with tech companies and other automakers to share development costs for new technologies.

Economic Implications for the US Auto Industry

The economic implications of the 2025 EPA emissions standards extend beyond direct manufacturing costs, potentially reshaping the entire US auto industry landscape. A 10% increase in production costs could challenge smaller manufacturers or those with less diversified product lines, potentially leading to market consolidation. The shift towards EVs also has significant ramifications for the automotive supply chain, favoring suppliers of electric components over traditional engine and transmission part manufacturers.

Job markets are also expected to see shifts. While some roles in traditional powertrain manufacturing may decline, new jobs in battery production, EV assembly, and charging infrastructure development are anticipated to emerge. This transition requires significant investment in workforce training and development to ensure a smooth transition and maintain US competitiveness in the global automotive sector.

Broader Economic Ripple Effects

The transformation driven by these standards could also influence international trade dynamics, as US automakers vie for global market share in the rapidly expanding EV segment. Government incentives, both federal and state, will play a crucial role in cushioning the economic impact and accelerating the transition, helping to maintain consumer demand and industry stability.

Furthermore, the long-term environmental benefits of reduced emissions could lead to public health savings and decreased climate-related economic damages, offering a societal return on the industry’s investment. However, the immediate challenge remains managing the upfront costs and ensuring a competitive, innovative US auto industry.

The Future Landscape: Innovation and Sustainability

The 2025 EPA emissions standards, despite their immediate cost implications, are fundamentally driving the US auto industry towards a future defined by innovation and sustainability. Manufacturers are not just reacting to regulations; they are actively engaging in a transformative period that will redefine personal transportation. This includes breakthroughs in battery technology, vehicle-to-grid capabilities, and autonomous driving systems, all integrated into more environmentally friendly vehicles.

The push for lower emissions is fostering a competitive environment where companies are striving to develop not only compliant but also superior products. This includes vehicles with longer ranges, faster charging times, and enhanced performance, which ultimately benefit the consumer. The focus on sustainability is also leading to more responsible sourcing of materials and more efficient manufacturing processes, contributing to a circular economy.

Long-Term Vision and Technological Advancements

Beyond the immediate compliance, the industry is looking at a future where EVs are not just alternatives but the dominant form of transportation. This vision is supported by continuous advancements in solid-state batteries, hydrogen fuel cells, and smart charging solutions. The regulatory pressure is acting as a catalyst for these innovations, accelerating their journey from research labs to mass production.

The integration of digital technologies, artificial intelligence, and advanced analytics in vehicle design and manufacturing is also becoming more prevalent. This helps optimize efficiency, reduce waste, and improve the overall environmental footprint of vehicle production. The 2025 standards are a critical step in a much larger journey towards a fully sustainable and technologically advanced automotive ecosystem.

| Key Point | Brief Description |

|---|---|

| 2025 EPA Standards | New regulations for light-duty vehicle emissions, initiating a push towards cleaner transport. |

| 10% Cost Increase | Projected rise in US auto manufacturing costs due to compliance requirements and EV investments. |

| Vehicle Pricing Impact | Higher manufacturing costs are expected to lead to increased consumer prices for new vehicles. |

| Industry Adaptation | Automakers are investing in EV platforms, supply chain optimization, and R&D to meet targets. |

Frequently Asked Questions About EPA Emissions Standards

The core objectives are to significantly reduce greenhouse gas emissions from light-duty vehicles, mitigate climate change impacts, and accelerate the transition towards zero-emission vehicles, primarily electric vehicles, across the US automotive market.

The 10% increase is projected due to substantial investments required for EV battery production, advanced powertrain research and development, and the retooling of manufacturing facilities to accommodate new technologies and production lines for cleaner vehicles.

It is highly anticipated that the increased manufacturing costs will be partially passed on to consumers, leading to higher sticker prices for new vehicles. This could make purchasing compliant new cars, especially EVs, more expensive initially.

Automakers are focusing on accelerating EV platform development, optimizing supply chains for critical EV components, investing in advanced materials and manufacturing techniques, and forming strategic partnerships to share technological development costs and expertise.

Beyond direct costs, the standards could lead to market consolidation, shifts in the automotive supply chain favoring EV component suppliers, and changes in the workforce, requiring significant retraining and the creation of new jobs in green technologies.

What Happens Next

As the 2025 EPA emissions standards approach, the US auto industry is bracing for a period of accelerated transformation. The immediate focus will be on the efficacy of automaker strategies to absorb or mitigate the projected 10% cost increase, and how these costs ultimately influence consumer purchasing decisions. Watch for continued debates over federal incentives and infrastructure investments, which will be crucial in balancing affordability with environmental goals. The coming months will reveal the initial market response to these changes, setting the stage for the broader implications through 2032 and beyond in the global push for sustainable transportation.