US Auto Industry Q1 2025: Supply Chain Shift Analysis

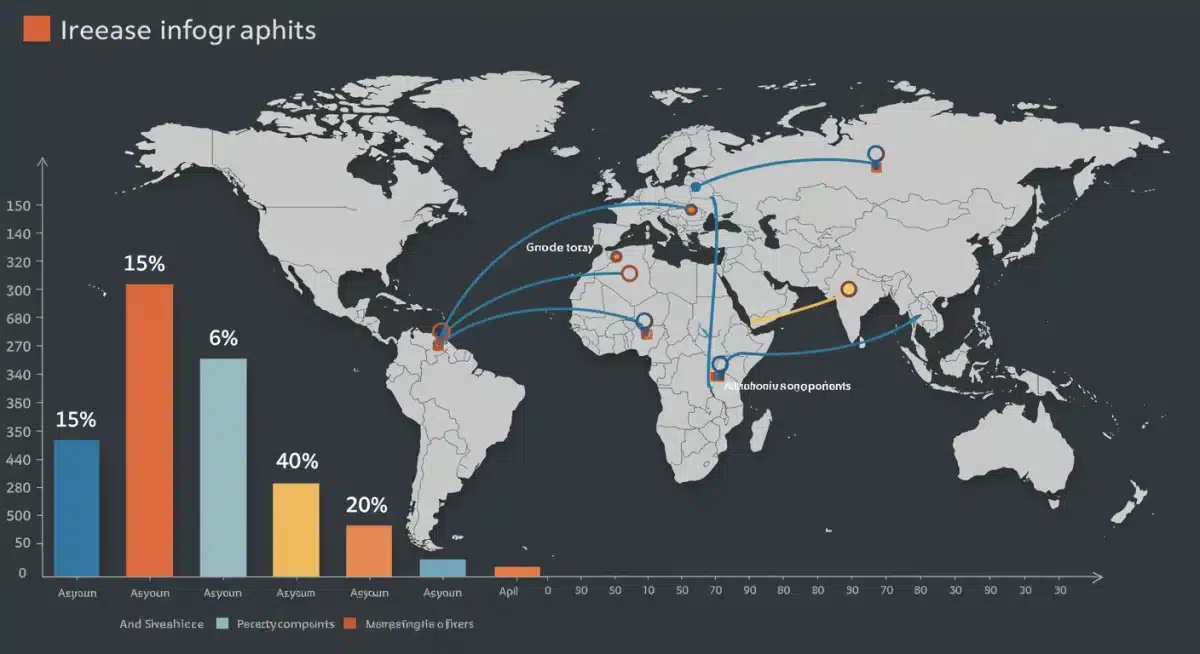

The US auto industry is bracing for a significant 15% shift in supply chain logistics and costs in Q1 2025, driven by geopolitical factors and evolving trade policies. This immediate change impacts production, pricing, and strategic planning across the sector.

The US Auto Industry Q1 2025: Analyzing a 15% Shift in Supply Chain Logistics and Costs is now front and center for manufacturers, suppliers, and consumers alike. Recent developments indicate a substantial recalibration of global supply networks, prompting immediate concern and strategic adjustments across the automotive sector. This isn’t merely a minor fluctuation; it’s a pronounced shift that demands prompt attention and proactive measures from all stakeholders.

Understanding the 15% Supply Chain Shift

The automotive industry is no stranger to supply chain volatility, yet the projected 15% shift in logistics and costs for Q1 2025 represents a significant challenge. This percentage increase is not uniform across all components or regions but reflects an aggregate impact on the overall operational expenditure for bringing vehicles to market. Industry analysts and major automotive groups are actively modeling these changes to understand their full scope.

This shift is largely attributed to a confluence of factors, including escalating geopolitical tensions affecting key trade routes, new regulatory frameworks impacting international shipping, and a continued push towards localized sourcing which, while offering stability, often comes with higher initial setup and operational costs. The implications are broad, touching everything from raw material procurement to finished vehicle delivery.

Geopolitical Undercurrents and Trade Route Disruptions

Recent international events have underscored the fragility of established trade corridors. The automotive sector, heavily reliant on a just-in-time inventory system and globalized production, is particularly vulnerable. Disruptions in critical maritime passages and increased tariffs in certain regions are forcing companies to reroute shipments, leading to longer transit times and higher freight expenses.

- Increased shipping insurance premiums due to perceived risks.

- Diversion of cargo ships, adding days or weeks to delivery schedules.

- Heightened scrutiny at borders, leading to potential delays in customs.

Rising Energy and Labor Costs

Beyond direct shipping disruptions, the underlying costs of logistics are also seeing an upward trend. Global energy prices, while volatile, have shown an overall increase, directly impacting fuel surcharges for air, sea, and land transport. Concurrently, a tightening labor market in key logistics hubs is driving up wages for truckers, warehouse staff, and port workers, contributing to the overall cost burden.

Impact on Automotive Manufacturing and Production

The immediate consequence of this 15% shift is a direct hit on manufacturing efficiency and production schedules. Auto manufacturers operate on incredibly tight margins and highly optimized production lines. Any significant increase in component costs or delays in delivery can ripple through the entire system, leading to production slowdowns, reduced output, and ultimately, fewer vehicles available for sale.

Companies are now re-evaluating their inventory strategies, moving away from lean, just-in-time models towards holding larger buffer stocks of critical components. While this mitigates the risk of sudden shortages, it also ties up capital and increases warehousing costs, adding another layer to the overall expense structure. This strategic pivot is a direct response to the lessons learned from recent global disruptions.

Component Sourcing Challenges

The shift is particularly pronounced in the sourcing of specialized components, such as semiconductors and advanced battery materials. Many of these are produced in concentrated geographic areas, making their supply chains inherently susceptible to regional instabilities. The increased costs associated with these critical parts will inevitably translate into higher manufacturing expenses.

- Difficulty in securing long-term contracts at stable prices.

- Increased reliance on multiple suppliers to mitigate single-point failure risks.

- Pressure to invest in domestic or near-shore production capabilities.

Production Line Adjustments and Efficiency

Automakers are exploring various strategies to maintain production targets amidst these challenges. This includes optimizing existing production lines for flexibility, investing in automation to reduce labor dependency, and even redesigning vehicles to utilize more readily available components. The goal is to absorb some of the increased costs without passing the full burden directly to consumers.

Consumer Outlook: Pricing and Availability

For the average consumer, the 15% shift in supply chain logistics and costs will likely manifest in two primary ways: higher vehicle prices and potentially longer waiting times for new cars. While manufacturers will attempt to absorb some of these costs, a significant portion is expected to be passed on to the end-user, impacting affordability and purchasing decisions.

The availability of certain models, particularly those heavily reliant on affected supply chains, could also become an issue. Niche vehicles or those requiring highly specialized parts might see more pronounced delays or price adjustments. This situation could further fuel the demand for used vehicles, potentially driving up prices in that segment as well.

New Vehicle Pricing Trends

Analysts project an average increase in the Manufacturer’s Suggested Retail Price (MSRP) for new vehicles, though the exact percentage will vary by brand and model. This increase will reflect not only the direct rise in logistics costs but also the additional expenses incurred by manufacturers for inventory holding, supply chain diversification, and production adjustments. Consumers should anticipate less aggressive discounting.

Delivery Delays and Order Backlogs

Even with efforts to mitigate disruptions, some level of delivery delay is almost inevitable. Dealerships may experience longer lead times for restocking popular models, leading to continued order backlogs. This could influence consumer behavior, pushing some buyers to consider alternative brands or models that have more robust or localized supply chains.

- Reduced inventory on dealership lots.

- Extended wait times for custom orders.

- Potential for fewer incentives and promotions.

Strategic Responses from Auto Manufacturers

In response to the evolving landscape, leading US auto manufacturers are implementing a range of strategic measures aimed at building greater resilience into their operations. This includes a multi-pronged approach focusing on diversification, technology adoption, and collaborative partnerships.

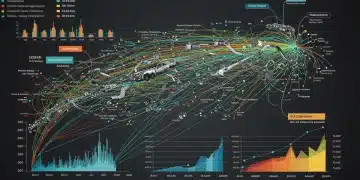

Many companies are actively investing in advanced analytics and AI-driven platforms to gain better visibility into their vast supply networks. This allows for real-time monitoring of potential bottlenecks and proactive decision-making, moving away from reactive problem-solving to predictive mitigation. The goal is to identify and address issues before they escalate into major disruptions.

Diversifying Supply Sources

One of the most critical strategies is the active diversification of supply sources. Manufacturers are reducing their reliance on single-country or single-supplier relationships, spreading their procurement across multiple regions and vendors. While this can increase complexity, it significantly lowers the risk of a complete shutdown due to a localized issue.

Near-Shoring and Reshoring Initiatives

There’s a noticeable trend towards near-shoring and reshoring production, particularly for high-value or critical components. Bringing manufacturing closer to the assembly plants in the US or to neighboring countries reduces transit times, minimizes exposure to international shipping disruptions, and potentially lowers overall logistics costs in the long run. This also aligns with governmental pushes for increased domestic manufacturing capabilities.

- Increased investment in domestic manufacturing facilities.

- Development of regional supply chain hubs.

- Collaboration with local suppliers to build capacity.

Governmental and Policy Influences

Governmental policies and international trade agreements play a pivotal role in shaping the operating environment for the US auto industry. The 15% shift is not occurring in a vacuum; it is heavily influenced by ongoing policy debates, new legislation, and evolving geopolitical alliances. These factors can either exacerbate or alleviate the pressures on supply chains.

Regulatory bodies are increasingly focusing on supply chain transparency and resilience, pushing for stricter reporting requirements and incentivizing domestic production. This includes tax credits for manufacturing in the US and initiatives to de-risk critical supply chains, particularly for technologies vital to the future of mobility, such as electric vehicle components.

Trade Policy Adjustments

New trade policies and tariffs, or the threat thereof, can significantly alter the economic viability of importing certain components. Automakers are closely monitoring trade negotiations and policy shifts to anticipate potential impacts on their sourcing strategies and cost structures. The aim is to navigate these complex regulations without incurring punitive duties.

Infrastructure Investment

Investments in domestic infrastructure, including improved port facilities, modernized rail networks, and enhanced interstate highways, are crucial for supporting a more resilient supply chain. While these are long-term projects, their planning and initial phases can signal governmental commitment to supporting the automotive sector’s logistical needs.

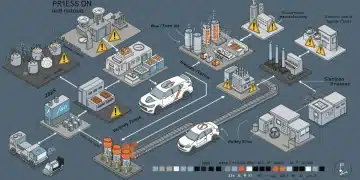

Technological Innovations in Supply Chain Management

Technology is emerging as a critical enabler for mitigating the impacts of the 15% shift in supply chain logistics and costs. From advanced data analytics to blockchain and automation, innovations are providing manufacturers with unprecedented tools to manage complexity and enhance efficiency.

Digital twins of supply chains, for instance, are allowing companies to simulate different disruption scenarios and test mitigation strategies virtually before implementing them in the real world. This proactive approach helps in identifying vulnerabilities and optimizing responses, ensuring greater continuity amidst unpredictable events. The integration of AI and machine learning is making these systems even more sophisticated.

AI and Predictive Analytics

AI-powered predictive analytics are revolutionizing demand forecasting and inventory management. By analyzing vast datasets, these systems can anticipate market fluctuations, predict potential supply shortages, and optimize order placement, thereby reducing waste and ensuring that components arrive precisely when needed, even with increased lead times.

- Real-time tracking of shipments and inventory.

- Automated reordering based on consumption patterns.

- Identification of alternative suppliers through data analysis.

Blockchain for Transparency and Traceability

Blockchain technology offers the promise of enhanced transparency and traceability across the entire supply chain. By creating an immutable record of every transaction and movement of goods, manufacturers can verify the origin and authenticity of components, track their journey from source to factory, and quickly identify points of failure or delay. This level of visibility is invaluable in a complex global network.

| Key Point | Brief Description |

|---|---|

| 15% Shift Impact | Projected increase in US auto supply chain logistics and costs for Q1 2025, affecting production and pricing. |

| Driving Factors | Geopolitical tensions, new regulations, and rising energy/labor costs contribute to the shift. |

| Manufacturer Response | Diversifying suppliers, near-shoring, and adopting advanced technologies like AI to build resilience. |

| Consumer Outlook | Anticipate higher new vehicle prices and potential delivery delays impacting buyer decisions. |

Frequently Asked Questions About Auto Supply Chain Shifts

The shift is primarily driven by a combination of escalating geopolitical tensions affecting trade routes, the implementation of new international trade regulations, and persistent increases in global energy and labor costs across the logistics sector. These factors collectively raise the operational expenses for automotive manufacturers.

Consumers should anticipate higher prices for new vehicles. While manufacturers will strive to absorb some of the increased logistics and component costs, a significant portion is expected to be passed on. This could lead to less competitive pricing and fewer promotional offers across various models and brands in the market.

Automakers are adopting several strategies, including diversifying their supplier base to reduce reliance on single sources, pursuing near-shoring and reshoring initiatives for critical components, and investing heavily in advanced technologies like AI and predictive analytics to enhance supply chain visibility and resilience against disruptions.

Yes, vehicle availability could be impacted. The increased costs and potential delays in component delivery may lead to production slowdowns, resulting in reduced inventory at dealerships and longer waiting times for consumers, especially for models with complex or globally sourced parts. Order backlogs might become more common.

Governmental policies are playing a crucial role through trade agreements, tariffs, and incentives for domestic manufacturing. There’s a growing focus on strengthening national supply chain resilience, with policies encouraging production within the US and its allies, which can both mitigate risks and potentially increase certain operational costs.

What Happens Next

The 15% shift in US Auto Industry Q1 2025: Analyzing a 15% Shift in Supply Chain Logistics and Costs signals a critical period for the sector. What happens next will largely depend on the agility of manufacturers to adapt their strategies and the responsiveness of governmental policies to create a more stable operating environment. We anticipate continued investment in localized production, further technological integration in logistics, and a heightened focus on geopolitical risk assessment. Consumers should monitor market trends closely, as the full impact on vehicle pricing and availability will unfold throughout 2025. This evolving situation underscores the automotive industry’s ongoing transformation in a volatile global economy.