2025 Raw Material Market: US Auto Budget Impact Up to 8%

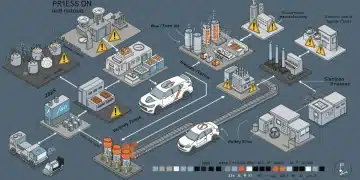

The 2025 raw material market is projecting significant cost increases for US auto production budgets, with industry analysts forecasting potential impacts of up to 8% due to volatile supply chains and geopolitical factors.

Breaking news from the economic front indicates that the 2025 Raw Material Market: How Fluctuations are Affecting US Auto Production Budgets by up to 8% is becoming a critical concern for manufacturers. As we move closer to 2025, industry leaders are grappling with anticipated volatility in key commodity prices, a situation poised to significantly reshape the automotive landscape.

Unpacking the 2025 Raw Material Market Volatility

The global raw material market is currently a complex web of supply chain challenges, geopolitical tensions, and shifting demand. For the US automotive sector, these dynamics are not merely theoretical; they translate directly into tangible cost pressures. Experts are now warning that these fluctuations could escalate production budgets by as much as 8% in the upcoming year, a figure that demands immediate attention from automakers and policymakers alike.

Several factors are converging to create this volatile environment, ranging from ongoing energy crises to the strategic stockpiling of critical minerals. Understanding these underlying causes is essential for forecasting and mitigating the financial impact on vehicle manufacturing.

Key Drivers of Price Instability

The primary forces driving raw material price instability are multifaceted and interconnected. These include:

- Geopolitical conflicts disrupting established trade routes and production hubs.

- Increased global demand for electric vehicle (EV) battery components like lithium and cobalt.

- Inflationary pressures across major economies, raising extraction and processing costs.

- Environmental regulations and sustainability initiatives impacting mining operations and material availability.

Each of these elements contributes to an unpredictable market, making long-term procurement strategies increasingly challenging for automotive companies. The ripple effect extends beyond direct material costs, influencing logistics, labor, and overall operational expenditures.

The Direct Impact on US Auto Production Budgets

The projected 8% increase in US auto production budgets due to raw material fluctuations represents a substantial financial burden. This percentage, while seemingly small, can translate into billions of dollars for an industry operating on tight margins and high volumes. Automakers are now evaluating various strategies to absorb or pass on these additional costs, a decision that will ultimately affect vehicle pricing and consumer affordability.

This situation is particularly acute for manufacturers heavily reliant on specific metals and minerals. The supply chain for these materials is often global and complex, making it vulnerable to disruptions at any point. The ongoing shift towards electrification further exacerbates this issue, as EVs require a different basket of critical materials compared to traditional internal combustion engine vehicles.

Critical Materials Under Scrutiny

A closer look at the materials most affected reveals a clear trend. These are often those essential for advanced technologies and sustainable mobility:

- Lithium: Crucial for EV batteries, demand continues to outstrip supply in certain regions.

- Cobalt: Another key battery component, often sourced from politically unstable areas.

- Nickel: Used in both traditional steel alloys and advanced battery chemistries.

- Steel & Aluminum: foundational materials for vehicle bodies and components, experiencing price hikes due to energy costs and industrial demand.

The price movements of these specific commodities are being monitored daily by procurement teams. Any sudden spike can trigger immediate adjustments to production forecasts and budget allocations. The automotive sector’s reliance on these materials means that their market behavior directly dictates the financial health and strategic planning of major players.

Supply Chain Vulnerabilities and Geopolitical Tensions

The vulnerabilities within the global supply chain for raw materials are more exposed than ever, significantly influenced by geopolitical tensions. Recent events have highlighted how easily the flow of essential goods can be interrupted, leading to price surges and manufacturing delays. For the US automotive industry, this means an increased risk of production halts and a greater need for resilient sourcing strategies.

Nations are increasingly viewing critical raw materials as strategic assets, leading to policies that prioritize domestic supply or secure access through international agreements. This can create bottlenecks and competitive pressures in the open market, directly impacting US manufacturers who operate within a global procurement framework. The implications are far-reaching, affecting everything from inventory management to long-term investment decisions.

Strategies for Mitigating Supply Risks

Automakers are not passively accepting these risks; they are actively developing and implementing strategies to mitigate supply chain vulnerabilities. These approaches aim to enhance resilience and reduce dependence on single-source suppliers or volatile regions.

- Diversification of sourcing to include multiple suppliers from different geographical locations.

- Investment in recycling infrastructure to recover valuable materials from end-of-life vehicles and batteries.

- Forging long-term contracts and strategic partnerships with mining companies and material processors.

- Exploring alternative materials and innovative designs that reduce reliance on high-risk commodities.

These proactive measures are vital for safeguarding production schedules and managing costs in an unpredictable global economy. The ability to adapt quickly to supply disruptions is becoming a key competitive advantage in the automotive sector.

Technological Advancements and Material Alternatives

In response to the escalating costs and supply chain risks associated with traditional raw materials, the automotive industry is vigorously pursuing technological advancements and exploring material alternatives. Innovation in this area is not just about cost reduction; it’s also about sustainability and reducing environmental footprints. New materials and manufacturing processes could offer a pathway to greater stability and efficiency in vehicle production.

Research and development efforts are focused on creating lighter, stronger, and more cost-effective materials that can replace or augment current components. This includes everything from advanced composites to novel battery chemistries that require less of the most expensive or scarce elements. The pace of these developments is accelerating, driven by both economic necessity and regulatory pressures for greener manufacturing.

Innovations Shaping Future Automotive Materials

Several key areas of innovation are currently showing significant promise for future automotive material strategies:

- Solid-State Batteries: These next-generation batteries promise higher energy density and potentially reduce reliance on liquid electrolytes and some critical metals.

- Advanced High-Strength Steels (AHSS): Offering improved strength-to-weight ratios, allowing for lighter vehicle structures without compromising safety.

- Carbon Fiber Composites: Increasingly used in structural components to reduce weight, though cost remains a barrier for mass-market adoption.

- Recycled Plastics and Bio-based Materials: Growing interest in sustainable interior components and non-structural parts, reducing dependence on virgin petrochemicals.

These advancements are critical for the long-term viability and competitiveness of the US automotive industry. They offer a dual benefit of addressing material scarcity and aligning with evolving consumer and regulatory demands for environmentally friendly products.

Economic Forecasts and Industry Outlook for 2025

As 2025 approaches, economic forecasts for the automotive industry are being closely watched, particularly in light of the anticipated raw material cost increases. Analysts predict a mixed outlook, with some segments potentially facing greater challenges than others. The overall health of the global economy, consumer spending patterns, and interest rates will all play significant roles in how the US auto sector navigates these headwinds.

The potential for an 8% increase in production budgets due to raw material fluctuations is not occurring in isolation. It intertwines with broader economic trends, including inflation, labor costs, and evolving trade policies. Industry leaders are preparing for a period that demands strategic agility and robust financial planning to maintain profitability and market share.

Key Economic Indicators to Monitor

Several economic indicators are particularly relevant to the automotive industry’s performance in 2025:

- Inflation Rates: Persistent inflation can further erode purchasing power and increase operational costs.

- Interest Rates: Higher rates affect financing for both consumers and manufacturers, potentially dampening demand.

- Consumer Confidence: A strong indicator of willingness to make large purchases like new vehicles.

- Global GDP Growth: Affects demand for vehicles in international markets, crucial for export-oriented manufacturers.

These indicators collectively paint a picture of the economic environment in which US automakers will operate. Their ability to adapt to these conditions, while managing raw material costs, will define their success in the coming year.

Strategic Responses from US Automakers

In the face of looming challenges from the 2025 Raw Material Market, US automakers are not standing idle. They are actively implementing a range of strategic responses designed to mitigate the impact on production budgets and maintain competitiveness. These strategies encompass everything from innovative procurement practices to significant investments in vertical integration and research and development.

The industry is recognizing that a reactive approach is no longer sufficient. Instead, a proactive and adaptive mindset is essential for navigating the complexities of the modern global economy. Companies are looking beyond immediate cost-cutting measures to build long-term resilience and secure future supply chains.

Proactive Measures and Investments

Automakers are deploying a variety of proactive measures to address the raw material challenge:

- Vertical Integration: Investing in mining operations or material processing facilities to secure direct access to critical raw materials, reducing reliance on volatile external markets.

- Hedging Strategies: Utilizing financial instruments to lock in prices for key commodities, offering a degree of predictability against market fluctuations.

- Collaboration and Partnerships: Forming alliances with suppliers, competitors, and even governments to share risks and secure collective bargaining power for raw material procurement.

- Enhanced Forecasting & Analytics: Implementing advanced data analytics and AI-driven tools to better predict market trends and potential supply disruptions, allowing for more informed decision-making.

These strategic responses are indicative of an industry that is learning from past supply chain crises and preparing for a future where raw material access and cost stability are paramount. The goal is to build a more robust and self-reliant automotive manufacturing ecosystem within the US.

| Key Impact Area | Brief Description of Impact |

|---|---|

| Production Budgets | Anticipated increase of up to 8% due to volatile raw material costs. |

| Supply Chain Resilience | Increased vulnerability due to geopolitical tensions and concentrated sourcing. |

| Material Innovation | Focus on alternative materials and advanced manufacturing to reduce reliance on scarce commodities. |

| Strategic Responses | Automakers are implementing vertical integration, hedging, and partnerships. |

Frequently Asked Questions About the 2025 Raw Material Market

The main concern for US auto production budgets in 2025 is the anticipated volatility and potential increase in raw material costs. Industry analysts project these fluctuations could raise production budgets by up to 8%, significantly impacting manufacturing expenses and overall profitability for automakers.

Key raw materials most affecting automotive costs include lithium, cobalt, and nickel, primarily due to their essential role in electric vehicle batteries. Additionally, traditional materials like steel and aluminum are also experiencing price hikes influenced by energy costs and global industrial demand.

Geopolitical tensions are significantly impacting raw material availability by disrupting established global supply chains and trade routes. This leads to increased scarcity, higher prices, and greater uncertainty for manufacturers trying to secure essential materials for their production processes globally.

Automakers are employing various strategies to mitigate raw material risks, including diversifying their sourcing, investing in recycling technologies, forging long-term supplier partnerships, and implementing vertical integration. These measures aim to enhance supply chain resilience and reduce dependence on volatile markets.

Yes, it is highly probable that these raw material cost increases will affect vehicle prices for consumers. Automakers may pass on a portion of their increased production budgets to maintain profitability, potentially leading to higher sticker prices for new cars and trucks in the 2025 market.

Looking Ahead: Navigating the New Economic Realities

The anticipated impact of the 2025 Raw Material Market on US auto production budgets, with potential increases of up to 8%, underscores a fundamental shift in global manufacturing. This is not merely a cyclical market fluctuation but a reflection of deeper structural changes in supply chains, geopolitical dynamics, and the accelerating transition to new energy technologies. Industry stakeholders must now focus on building robust, adaptable systems that can withstand future shocks. The coming months will reveal which automakers are best equipped to innovate, collaborate, and strategically invest to secure their future in an increasingly complex economic landscape. Watch for continued developments in materials science, international trade agreements, and corporate investment strategies as the industry recalibrates for 2025 and beyond.