2025 Tariff Adjustments: Impact on US Imported Auto Parts

The 2025 tariff adjustments are poised to significantly reshape the landscape for US imported auto parts, impacting costs, supply chains, and consumer prices across the automotive industry.

As the automotive industry braces for significant shifts, understanding the 2025 Tariff Adjustments: What They Mean for Imported Auto Parts in the US becomes critically important. These impending changes are set to redefine how auto manufacturers and consumers interact with the global supply chain. What exactly do these adjustments entail, and how will they ripple through the market?

Understanding the New Tariff Landscape for 2025

The Biden administration has announced a series of tariff adjustments slated for implementation in 2025, directly targeting key sectors, including automotive parts. These changes are part of a broader strategy to rebalance trade relationships and bolster domestic manufacturing capabilities. The specifics of these adjustments are now coming into sharper focus, providing a clearer picture of the challenges and opportunities ahead for the US automotive industry.

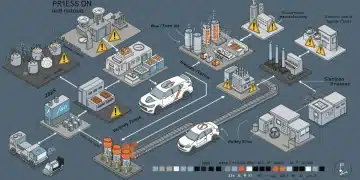

According to recent reports from the Office of the United States Trade Representative (USTR), the tariffs will primarily affect certain categories of imported goods from specific countries, with a notable emphasis on components critical to vehicle production. This move is designed to encourage a shift towards more localized production and reduce reliance on foreign supply chains, particularly in areas deemed strategically important for national economic security.

Key Components Under Scrutiny

Several types of auto parts are expected to face increased tariffs. These include, but are not limited to, advanced battery components, certain electronic control units (ECUs), and specialized steel and aluminum parts. The selection of these items reflects concerns over intellectual property, fair trade practices, and the desire to build a more resilient domestic industrial base.

- Battery Components: Critical for electric vehicles (EVs), these components are central to the new tariff strategy.

- Electronic Control Units (ECUs): Essential for modern vehicle functionality, these complex units are often sourced internationally.

- Specialized Metals: Certain grades of steel and aluminum, vital for structural integrity and performance, are also on the list.

Direct Impact on US Auto Manufacturers and Supply Chains

The impending 2025 tariff adjustments are set to create significant ripples throughout the US auto manufacturing sector. Manufacturers, already navigating complex global supply chains, must now re-evaluate their sourcing strategies to mitigate potential cost increases and disruptions. This immediate challenge requires swift action and strategic planning to maintain competitiveness and production schedules.

Companies that heavily rely on imported auto parts from targeted regions will likely experience an immediate increase in their input costs. This could translate into higher manufacturing expenses, potentially squeezing profit margins or necessitating price adjustments for consumers. The automotive industry is highly sensitive to cost fluctuations, making these tariff changes a critical point of concern for executives and investors alike.

Supply Chain Reconfiguration

Many manufacturers are already exploring alternative sourcing options, including diversifying their supplier base or bringing production closer to home. This shift, while potentially beneficial in the long run for domestic job creation and supply chain resilience, involves significant upfront investment and can be time-consuming to implement effectively. The transition period itself could pose challenges related to availability and quality control.

- Diversifying Suppliers: Companies are actively seeking new partners in non-tariff-affected regions.

- Nearshoring/Reshoring: There’s a growing incentive to relocate manufacturing facilities to the US or neighboring countries.

- Inventory Management: Adjustments to inventory levels may be necessary to buffer against potential supply disruptions.

Anticipated Effects on Consumer Prices and Vehicle Availability

One of the most immediate and tangible consequences of the 2025 auto parts tariffs will likely be felt by consumers. As the cost of imported components rises for manufacturers, these increased expenses are often passed down the line, ultimately impacting the retail price of new and used vehicles. This could lead to higher sticker prices for consumers, potentially affecting purchasing decisions and market demand.

Beyond price, vehicle availability could also be a concern. If manufacturers struggle to secure necessary parts due to tariff-induced supply chain disruptions or increased costs, production delays might occur. This could result in longer waiting times for popular models and a reduced selection on dealership lots. The interconnected nature of the global automotive supply chain means that even tariffs on a few key components can have widespread effects.

Impact on Aftermarket Parts Market

The aftermarket auto parts sector, which provides components for vehicle repairs and maintenance, is also vulnerable. Many replacement parts are imported, and new tariffs could make these parts more expensive, increasing the cost of vehicle repairs for consumers. This could place an additional financial burden on vehicle owners, especially those with older models requiring frequent maintenance.

Moreover, the availability of specific aftermarket parts might decrease if suppliers find it uneconomical to import them under the new tariff regime. This could lead to a reliance on potentially lower-quality alternatives or extended wait times for crucial repairs, impacting vehicle safety and longevity.

Economic Implications and Domestic Manufacturing Boost

The primary stated goal behind the 2025 auto parts tariffs is to stimulate domestic manufacturing and reduce economic reliance on specific foreign nations. Proponents argue that by making imported goods more expensive, US-based production becomes more competitive, leading to job creation and economic growth within the country. This strategy aims to build a more robust and self-sufficient industrial base, particularly in critical sectors like automotive.

However, the economic implications are complex and multifaceted. While domestic manufacturers might see an advantage, industries reliant on imported components could face increased costs and reduced profitability. The balance between protecting domestic industries and maintaining affordable consumer prices is a delicate one, and the tariffs will test this equilibrium in the coming years.

Potential for Investment and Innovation

The tariffs could incentivize significant investments in US manufacturing facilities and research and development for auto parts. Companies might choose to invest in new technologies and production methods within the US to avoid tariff costs, fostering innovation and creating high-skilled jobs. This could lead to advancements in areas such as EV battery production, semiconductor manufacturing for automotive applications, and advanced material development.

- Increased Capital Expenditure: Expect to see more investment in US-based production plants.

- R&D Expansion: Greater focus on developing proprietary technologies and materials domestically.

- Job Growth: Potential for new manufacturing and engineering jobs in the auto sector.

Navigating Compliance and Strategic Responses

For businesses involved in the import and distribution of auto parts, understanding and complying with the 2025 auto parts tariffs will be paramount. The complexity of international trade regulations, coupled with the specific nuances of these new tariffs, necessitates a thorough review of current operational practices and a proactive approach to compliance. Companies must ensure their import documentation, classification codes, and valuation methods are accurate to avoid penalties and delays.

Beyond mere compliance, strategic responses will be crucial for maintaining business continuity and competitive advantage. This involves not only re-evaluating sourcing but also exploring opportunities for lobbying efforts, engaging with trade associations, and continuously monitoring policy developments. The fluidity of trade policy means that what is true today may evolve tomorrow, demanding constant vigilance.

Strategies for Mitigation

Businesses are currently exploring various strategies to mitigate the impact of the tariffs. These range from renegotiating contracts with international suppliers to exploring duty drawback programs and free trade agreements where applicable. The goal is to minimize the financial burden while ensuring a consistent supply of quality components for production. Legal and trade experts are playing a vital role in guiding companies through these complex decisions.

- Contract Renegotiation: Adjusting terms with suppliers to share tariff burdens or explore alternative pricing structures.

- Duty Drawback: Utilizing programs that allow for refunds of duties paid on imported goods that are subsequently exported.

- FTAs and Trade Zones: Leveraging existing free trade agreements or establishing operations in foreign trade zones to reduce tariff exposure.

Future Outlook and Long-Term Adaptations

The 2025 Tariff Adjustments: What They Mean for Imported Auto Parts in the US represent more than just a temporary hurdle; they signal a potential long-term shift in global automotive trade dynamics. The industry is entering a period of significant adaptation, where resilience and flexibility will be key to success. Companies that can effectively pivot their strategies and embrace new models of production and sourcing are likely to emerge stronger in the evolving landscape.

In the long term, these tariffs could accelerate the trend towards regionalized supply chains, where manufacturing and sourcing are concentrated within specific geographic blocs rather than spread globally. This could lead to greater stability and reduced vulnerability to geopolitical tensions, but it also necessitates substantial infrastructure development and investment in domestic capabilities. The automotive sector, known for its extensive global integration, will be a critical test case for this broader economic realignment.

Technological Integration and Automation

To offset potentially higher labor costs associated with domestic production, there will likely be increased investment in automation and advanced manufacturing technologies within the US. This could lead to a more efficient and technologically advanced domestic auto parts industry, capable of competing on quality and innovation, not just cost. The drive for localized production might thus become a catalyst for technological modernization across the sector.

The coming years will see continuous evaluation of these tariff policies and their effectiveness. Stakeholders across the automotive ecosystem will be closely watching for adjustments, exemptions, or further escalations. The ability of the US auto industry to adapt to these changes will define its trajectory for the next decade.

| Key Point | Brief Description |

|---|---|

| Targeted Components | New tariffs primarily affect EV battery parts, ECUs, and specialized metals. |

| Cost Increases | Manufacturers face higher input costs, potentially leading to increased vehicle prices for consumers. |

| Supply Chain Shifts | Companies are re-evaluating sourcing, exploring diversification and domestic production. |

| Domestic Boost | Aims to stimulate US manufacturing, job creation, and technological investment. |

Frequently Asked Questions About 2025 Auto Parts Tariffs

The 2025 tariffs are primarily targeting advanced battery components for electric vehicles, certain electronic control units (ECUs), and specialized steel and aluminum parts crucial for vehicle manufacturing and structural integrity. These are high-value, strategically important components.

Increased tariffs on imported auto parts will likely raise manufacturing costs for automakers. These higher expenses could be passed on to consumers, potentially leading to higher retail prices for new vehicles and possibly affecting their overall affordability and market demand.

Yes, tariffs could impact the aftermarket parts market, making imported replacement parts more expensive and potentially less available. This might increase repair costs for vehicle owners and could lead to longer waiting times for specific components, affecting maintenance schedules.

The primary goal is to bolster domestic manufacturing and reduce reliance on specific foreign supply chains for critical automotive components. This aims to create jobs within the US, strengthen national economic security, and rebalance international trade relationships in key sectors.

Manufacturers are actively re-evaluating their global supply chains, exploring options like diversifying suppliers, nearshoring or reshoring production, and investing in domestic manufacturing capabilities. They are also working with trade experts to navigate compliance and mitigation strategies.

What Happens Next

As the 2025 deadline approaches, the automotive industry and policymakers will closely monitor the initial impacts of these tariff adjustments. Expect ongoing discussions regarding potential exemptions or modifications as real-world economic data emerges. The long-term success of these tariffs in fostering domestic manufacturing and supply chain resilience will largely depend on the industry’s adaptability and the government’s willingness to fine-tune policies. This evolving situation underscores a critical moment for the US automotive sector, shaping its future trajectory in a rapidly changing global economy.