Automotive Manufacturing Robotics: 20% Efficiency Boost for US Plants

US automotive manufacturers are aggressively integrating advanced robotics to achieve a pivotal 20% increase in efficiency across their plants by 2025, driven by global competition and technological advancements.

As of late 2023, the US automotive sector is undergoing a significant transformation, with a bold target set: a 20% increase in efficiency for US plants by 2025 through the strategic deployment of automotive manufacturing robotics. This ambitious goal underscores the industry’s commitment to innovation and competitiveness in a rapidly evolving global market.

The Mandate for Robotic Integration in US Auto Plants

The push for greater efficiency in US automotive manufacturing is not merely an aspiration; it’s a strategic imperative. Global competition, rising labor costs, and the demand for higher quality and faster production cycles are forcing manufacturers to rethink traditional production models.

Recent reports from industry analysts indicate a substantial uptick in investment in automation technologies. This surge is directly linked to the identified potential of robotics to streamline operations, reduce waste, and enhance overall output. The 2025 target is a direct response to these market forces.

Driving Forces Behind Automation Adoption

- Global Competitiveness: International rivals have heavily invested in automation, compelling US plants to follow suit to maintain market share.

- Labor Shortages: Robotics addresses the growing challenge of finding and retaining skilled labor for repetitive or hazardous tasks.

- Quality and Precision: Robots offer unparalleled accuracy, reducing defects and improving product quality consistently.

- Cost Reduction: Automation can significantly lower operational costs over time by optimizing resource use and minimizing errors.

Current State of Robotics in Automotive Production

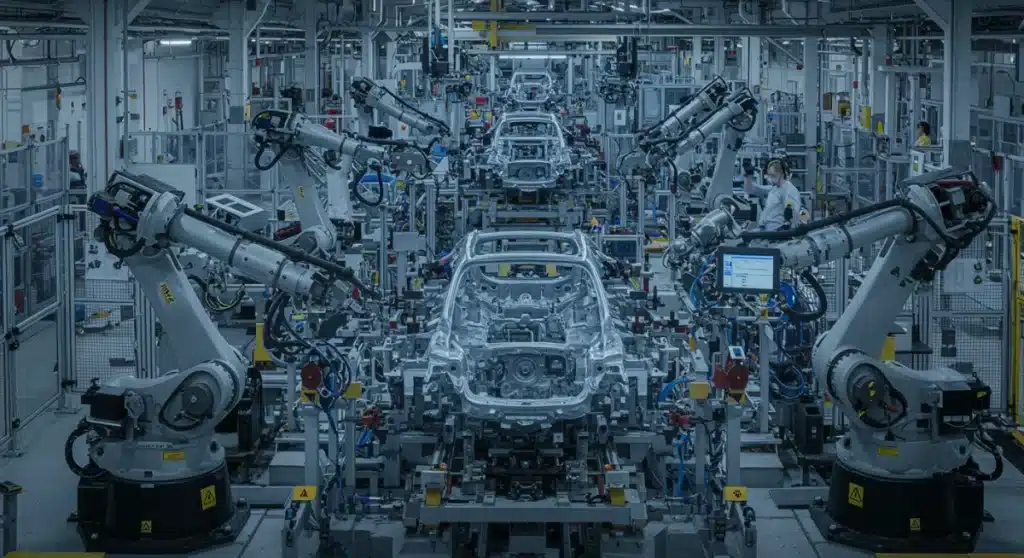

Today’s automotive plants are already a testament to robotic capabilities, with robots performing a wide array of tasks from welding and painting to assembly and quality inspection. However, the current phase involves moving beyond traditional, fixed automation to more flexible, intelligent, and collaborative robotic systems.

Manufacturers are leveraging advancements in artificial intelligence (AI) and machine learning (ML) to enable robots to learn, adapt, and perform more complex tasks with minimal human intervention. This evolution is crucial for achieving the targeted efficiency gains.

Key Robotic Technologies Driving Efficiency Gains

Several cutting-edge robotic technologies are at the forefront of this efficiency drive. These innovations are not only improving speed but also enhancing flexibility and safety on the factory floor.

The integration of these advanced systems promises to revolutionize how vehicles are manufactured, making production lines more dynamic and responsive to market demands. The focus is on creating smart factories where automation is seamlessly integrated.

Emerging Robotic Innovations

- Collaborative Robots (Cobots): Designed to work safely alongside human employees, cobots are increasing productivity in tasks requiring both human dexterity and robotic precision.

- Autonomous Mobile Robots (AMRs): These robots navigate factory floors independently, transporting materials and parts, optimizing logistics, and reducing bottlenecks.

- AI-Powered Vision Systems: Integrated with robots, these systems enable real-time quality control, defect detection, and precise assembly, far exceeding human capabilities in speed and consistency.

- Swarm Robotics: Although still emerging, swarm robotics involves multiple robots working in concert to complete complex tasks, offering unprecedented flexibility and scalability.

Challenges and Solutions in Robotic Implementation

While the benefits of advanced robotics are clear, US automotive plants face several challenges in achieving widespread implementation. These include significant upfront investment, the need for a skilled workforce to manage and maintain these systems, and the complexities of integrating new technologies with existing infrastructure.

To overcome these hurdles, manufacturers are increasingly forming partnerships with technology providers, investing in workforce training programs, and adopting modular, scalable robotic solutions. The industry is also exploring innovative financing models to ease the financial burden of large-scale automation projects.

Furthermore, cybersecurity is a growing concern with interconnected robotic systems. Robust security protocols are being developed and implemented to protect sensitive manufacturing data and prevent operational disruptions.

The Impact on Workforce and Job Creation

The widespread adoption of automotive manufacturing robotics often raises questions about its impact on the human workforce. While some roles may be automated, the shift is also creating new opportunities and demanding new skill sets.

Manufacturers are focusing on upskilling and reskilling programs to prepare their employees for roles in robotics programming, maintenance, and oversight. This transition is seen as an evolution of labor, where human ingenuity is augmented by robotic precision.

New Roles and Training Initiatives

- Robotics Technicians: Experts needed for installation, maintenance, and troubleshooting of robotic systems.

- AI and Automation Engineers: Professionals who design, program, and optimize robotic workflows.

- Data Analysts: Specialists who interpret data from automated systems to identify areas for further improvement.

- Human-Robot Collaboration Specialists: Roles focused on designing efficient and safe collaborative workspaces.

Achieving the 20% Efficiency Target by 2025

The 20% efficiency increase by 2025 for US automotive plants is an ambitious but attainable goal. It hinges on sustained investment, continuous technological innovation, and a strategic approach to integration.

Manufacturers are leveraging data analytics to identify specific areas where robotics can yield the highest returns, focusing on bottlenecks and high-volume processes. This targeted approach ensures that robotic deployments are maximally effective.

Furthermore, a culture of continuous improvement, where feedback loops from robotic operations inform future optimizations, is critical. The journey to 2025 is not just about installing robots but about transforming the entire manufacturing ecosystem.

Case Studies: Early Successes in Robotic Implementation

Several US automotive plants have already reported significant efficiency gains through strategic robotic deployments. These early successes provide valuable blueprints for others looking to achieve similar results.

For example, a major automaker recently implemented a fleet of AMRs for parts delivery, reducing internal logistics time by 15% and reallocating human labor to more complex tasks. Another plant utilized AI-powered vision systems for quality control, cutting defect rates by 10%.

These examples highlight the tangible benefits of robotics, demonstrating how targeted automation can lead to measurable improvements in productivity and quality. The lessons learned from these pioneering efforts are being shared across the industry to accelerate widespread adoption.

| Key Point | Brief Description |

|---|---|

| 20% Efficiency Target | US automotive plants aim to boost operational efficiency by 20% by 2025 using advanced robotics. |

| Key Technologies | Cobots, AMRs, and AI-powered vision systems are central to enhancing production. |

| Workforce Adaptation | Emphasis on upskilling and reskilling programs to prepare employees for new roles in automation. |

| Challenges & Solutions | Addressing investment, integration, and cybersecurity through partnerships and modular solutions. |

Frequently Asked Questions About Automotive Robotics Efficiency

The main objective is to achieve a 20% increase in operational efficiency across US automotive manufacturing plants by 2025, primarily through the strategic integration of advanced robotics and automation technologies.

Key technologies include collaborative robots (cobots), autonomous mobile robots (AMRs) for logistics, and AI-powered vision systems for enhanced quality control and precise assembly tasks on the production line.

While some tasks will be automated, the shift is expected to create new roles in robotics programming, maintenance, and oversight. Extensive upskilling and reskilling programs are being implemented for employees.

Significant challenges include high upfront investment costs, integrating new systems with legacy infrastructure, and ensuring a skilled workforce to manage the advanced robotic platforms. Cybersecurity is also a growing concern.

Achieving the 20% efficiency target will bolster the competitiveness of US automotive manufacturing on a global scale, improve product quality, reduce production costs, and foster innovation within the industry.

Looking Ahead: The Future of US Automotive Manufacturing

The drive for a 20% efficiency increase by 2025, fueled by automotive manufacturing robotics, signals a new era for US automotive plants. This aggressive push is not merely about incremental improvements but a fundamental redefinition of industrial production. What unfolds next will be critical: sustained investment in R&D, the evolution of human-robot collaboration, and the continuous adaptation of manufacturing processes will determine the long-term success of this transformation. The industry is poised for an exciting period of innovation, with implications reaching far beyond the factory floor into economic growth and global market positioning.