Semiconductor Shortage: Production Impacts Expected Until Mid-2025

The global semiconductor shortage, a critical issue since 2020, is now projected to persist until mid-2025, significantly impacting automotive production and potentially leading to increased vehicle prices and limited availability for consumers in the US.

The automotive industry continues to grapple with the repercussions of the global chip shortage. A critical update: Semiconductor shortage expected to last until mid-2025, impacting production timelines and potentially further squeezing vehicle supply in the US market.

Understanding the Persistent Semiconductor Shortage

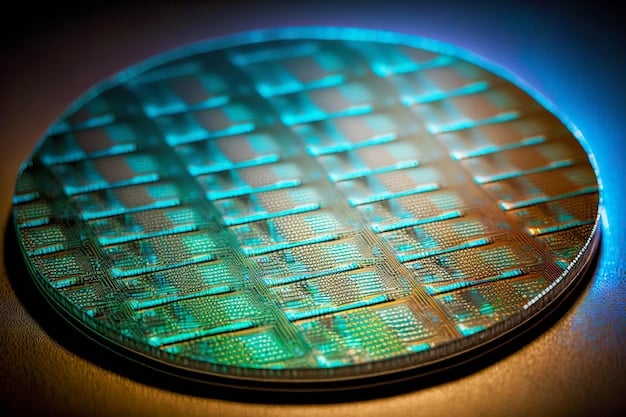

The semiconductor shortage has been a looming issue for several years, initially triggered by pandemic-related disruptions and compounded by increased demand across various sectors. Understanding why this shortage persists is crucial to grasping its far-reaching consequences.

Several factors contribute to the ongoing crisis, including:

Supply Chain Vulnerabilities

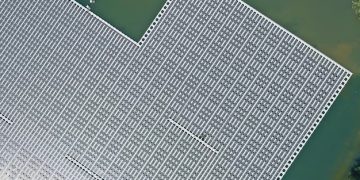

The semiconductor supply chain is incredibly complex and geographically dispersed, making it vulnerable to disruptions at any point. From raw materials extraction to fabrication and assembly, each stage relies on specialized resources and infrastructure, often concentrated in specific regions.

Geopolitical Tensions

Geopolitical tensions, particularly between the US and China, have further complicated the situation. Trade restrictions and concerns over national security have led to uncertainty and hindered the smooth flow of semiconductors across borders.

- Increased demand for electronic devices during the pandemic strained chip production.

- Factory shutdowns and logistical bottlenecks exacerbated supply chain issues.

- Geopolitical factors added another layer of complexity to the semiconductor market.

These converging factors paint a picture of a deeply entrenched shortage, not easily resolved in the short term. The automotive industry, heavily reliant on semiconductors for various vehicle systems, finds itself particularly exposed.

Impact on Automotive Production in the US

The critical update: Semiconductor shortage expected to last until mid-2025, impacting production is particularly worrisome for US automotive manufacturers. The production cuts and delays experienced in recent years are likely to continue, with significant consequences for both automakers and consumers.

The immediate impact of the shortage is evident in:

Reduced Vehicle Output

Automakers have been forced to significantly reduce production, leading to lower inventory levels at dealerships. This scarcity of new vehicles has driven up prices and extended wait times for consumers.

Delayed Vehicle Deliveries

Many customers who have placed orders for new vehicles face lengthy delays, sometimes stretching for months or even years. This uncertainty and frustration can lead to cancellations and lost sales for automakers.

- Major US automakers have already announced further production cuts due to chip shortages.

- Consumers face longer wait times and higher prices for new vehicles.

- The shortage is impacting the availability of specific features and trim levels.

The situation is further complicated by the fact that certain types of chips, particularly those used in older vehicle models, are in especially short supply. This impacts not only new vehicle production but also the availability of replacement parts for existing vehicles.

Pricing and Availability Concerns for Consumers

For US consumers, the ongoing semiconductor shortage translates to higher prices and limited availability. The basic economic principles of supply and demand are at play: with fewer vehicles available, dealerships can command higher prices.

Consumers are facing:

Increased Vehicle Prices

New vehicle prices have risen significantly in recent years, driven in part by the chip shortage. The rising cost of raw materials and other inputs has further compounded the problem.

Limited Inventory and Choices

With reduced production, consumers have fewer vehicles to choose from, and dealerships have less flexibility in negotiating prices. This lack of options can be frustrating and lead to consumers settling for vehicles that don’t fully meet their needs.

One potential strategy for consumers is to consider:

- Being flexible with vehicle features and trim levels to increase availability.

- Exploring used vehicle options, although prices in the used market have also risen.

- Being patient and willing to wait for a specific vehicle configuration.

However, even these strategies may not guarantee immediate relief, as the semiconductor shortage continues to cast a shadow over the automotive market.

Strategies for Automakers to Navigate the Crisis

Faced with the prolonged semiconductor shortage, US automakers are exploring various strategies to mitigate its impact and ensure business continuity. These strategies range from short-term fixes to long-term investments aimed at reshaping the supply chain.

Some key approaches include:

Renegotiating Supply Contracts

Automakers are seeking to renegotiate supply contracts with semiconductor manufacturers to secure a more stable and predictable supply of chips. This may involve long-term commitments and closer collaboration with chipmakers.

Diversifying Chip Suppliers

To reduce reliance on a limited number of suppliers, automakers are actively diversifying their chip sourcing. This involves exploring partnerships with new semiconductor manufacturers and expanding their geographical reach.

Investing in In-House Chip Design

Some automakers are even considering investing in in-house chip design capabilities. This would give them greater control over the design and production of critical semiconductors, reducing their vulnerability to external disruptions.

- Ford is working directly with chipmakers to improve supply chain visibility.

- GM is exploring alternative chip designs to reduce reliance on scarce components.

- Tesla has been relatively successful in navigating the shortage by quickly adapting its chip sourcing.

These strategies represent a significant shift in the automotive industry’s approach to supply chain management. Automakers are recognizing the importance of greater resilience and control over critical components.

Government Initiatives and Policy Implications

The US government is also taking steps to address the semiconductor shortage and strengthen domestic chip manufacturing capabilities. These initiatives aim to reduce reliance on foreign suppliers and ensure a more secure supply of semiconductors for critical industries.

Key government initiatives include:

The CHIPS Act

The CHIPS Act provides billions of dollars in funding for domestic semiconductor manufacturing and research. This aims to incentivize chipmakers to build new fabs in the US and boost the country’s global competitiveness.

Export Controls

The US government has implemented export controls on certain types of semiconductors to prevent them from being used for military applications by foreign adversaries. This has further complicated the global chip supply chain.

The implications of these policies are:

- Increased investment in domestic semiconductor manufacturing.

- Potential for greater US self-sufficiency in chip production.

- Continued geopolitical tensions in the semiconductor market.

The long-term impact of these initiatives remains to be seen, but they signal a clear commitment from the US government to address the semiconductor shortage and strengthen the domestic chip industry.

Long-Term Outlook and Industry Transformation

Looking beyond the immediate crisis, the semiconductor shortage is likely to accelerate several long-term trends in the automotive industry. These include the increasing electrification of vehicles, the rise of autonomous driving technology, and the growing importance of software-defined vehicles.

The future of automotive technology hinges on:

Electric Vehicle Adoption

Electric vehicles require significantly more semiconductors than traditional gasoline-powered cars. As EV adoption continues to grow, the demand for chips will only intensify.

Autonomous Driving Systems

Autonomous driving systems rely on a complex array of sensors, processors, and software, all of which require advanced semiconductors. The development and deployment of autonomous vehicles will further drive chip demand.

Software-Defined Vehicles

Modern vehicles are increasingly becoming software-defined, with many functions controlled by software running on embedded chips. This trend will transform the automotive industry, making software and semiconductors even more critical to vehicle performance and functionality.

In conclusion, critical update: Semiconductor shortage expected to last until mid-2025, impacting production, is more than just a temporary setback. It is a catalyst for long-term change, forcing automakers to rethink their supply chains, embrace new technologies, and adapt to a rapidly evolving automotive landscape.

| Key Point | Brief Description |

|---|---|

| ⚠️ Shortage End | Expected to last until mid-2025, impacting automotive production. |

| 🚗 Impact on Production | Reduced vehicle output and delayed deliveries affecting consumers. |

| 💰 Pricing Concerns | Consumers face increased vehicle prices and limited inventory choices. |

| 🌐 Govt Initiatives | Government actions such as the CHIPS Act aim to boost domestic chip manufacturing. |

Frequently Asked Questions

▼

The global semiconductor shortage is now projected to persist until mid-2025, according to recent industry analysis and reports.

▼

The shortage has led to reduced vehicle output, causing lower inventory levels at dealerships and longer wait times for customers ordering new vehicles.

▼

Consumers can be flexible with vehicle features, explore used vehicle options, and be patient when ordering, as the market adjusts to ongoing shortages.

▼

Automakers are renegotiating supply contracts, diversifying chip suppliers, and investing in in-house chip design to mitigate the impact of the long-term shortage.

▼

The US government is providing funding for domestic semiconductor manufacturing through acts like the CHIPS Act, aiming to reduce reliance on foreign suppliers.

Conclusion

The projected extension of the semiconductor shortage until mid-2025 presents ongoing challenges for the automotive industry and consumers in the US. By understanding the complexities of the shortage, exploring adaptive strategies, and recognizing the long-term implications, stakeholders can better navigate this evolving landscape.