Inflation’s Impact on the Automotive Market: A Deep Dive for US Consumers

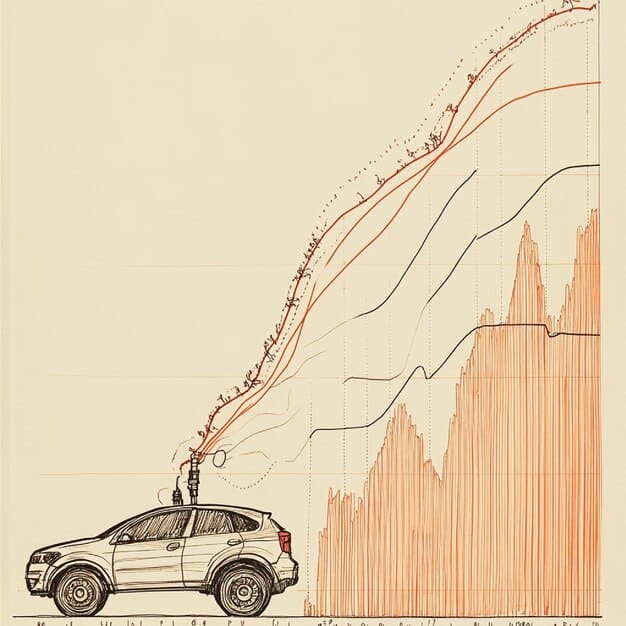

The Impact of Inflation on the Automotive Market includes rising vehicle prices, increased borrowing costs, and shifts in consumer behavior, affecting both new and used car sales in the United States.

Inflation is significantly reshaping the automotive market, impacting consumers and manufacturers alike. This detailed analysis, with the topic the impact of inflation on the automotive market: a deep dive will explore the multifaceted effects of rising prices on vehicle affordability and purchase decisions in the US.

Understanding the Current State of Inflation in the US Automotive Market

The US automotive market is currently grappling with persistent inflation. Understanding the causes and effects of these inflationary pressures is crucial for both consumers and industry stakeholders.

Key Drivers of Automotive Inflation

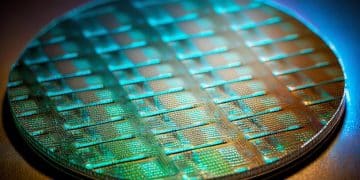

Several factors contribute to the rising prices of vehicles. Supply chain disruptions and increased material costs are two significant drivers. The increased demand, coupled with limited supply, also exacerbates inflationary pressures.

- Semiconductor Shortages: Limits car production globally.

- Raw Material Costs: Prices for steel, aluminum, and rubber have surged.

- Shipping and Logistics: Higher transportation costs impact final vehicle prices.

Impact on New and Used Car Prices

Inflation affects both new and used car markets but in slightly different ways. New car prices are directly influenced by production costs, while used car prices are more tied to supply and demand dynamics. As new car production struggles, demand for used cars rises, pushing their prices up as well.

The automotive industry has also seen an increase in leasing activity due to the inflated costs of vehicles. This rise is because many consumers are unable to purchase new cars given the new economic landscape.

In conclusion, the current state of inflation poses a severe challenge to the automotive market, leading to increased prices and altered consumer behavior. Recognizing the key drivers and impacts is essential for navigating this complex economic environment.

How Inflation is Affecting Car Manufacturers

Car manufacturers are facing considerable challenges due to the current inflationary environment. From increased production costs to shifts in consumer demand, they must adapt to maintain profitability and market share.

Rising Production Costs

One of the most immediate effects of inflation on car manufacturers is the increase in production costs. Prices for raw materials, components, and labor are all on the rise, squeezing profit margins.

Supply chain bottlenecks are another issue for manufacturers. They cannot make enough cars given the increased production costs.

Adjusting Pricing Strategies

To offset rising costs, manufacturers are adjusting their pricing strategies. Some are raising prices directly, while others are focusing on higher-margin models. Discounts and incentives are becoming less common as automakers prioritize profitability.

- Price Hikes: Direct increases in MSRP (Manufacturer’s Suggested Retail Price).

- Model Mix Adjustments: Shifting production towards more profitable models.

- Reduced Incentives: Fewer rebates and discounts for consumers.

The decision to increase prices impacts customer perceptions of the company. Despite these efforts, manufacturers still struggle to keep pace with rising expenses.

In conclusion, manufacturers need to adjust and adapt to maintain profitability and market share given the new economic landscape.

Consumer Behavior Shifts Due to Inflation

Inflation is driving significant changes in consumer behavior within the automotive market. As vehicle prices rise, buyers are becoming more cautious and strategic in their purchasing decisions.

Delaying Purchases and Seeking Alternatives

Many consumers are delaying new car purchases due to high prices. Instead, they are choosing to maintain their current vehicles longer or explore more affordable alternatives. This includes looking at used cars or smaller, more fuel-efficient models.

Some consumers are delaying purchases and looking at the market on a monthly basis in the hopes that they fall. Others have given up completely.

Increased Interest in Fuel-Efficient and Electric Vehicles

With rising gasoline prices, there’s a growing interest in fuel-efficient and electric vehicles (EVs). Consumers are looking for ways to reduce their overall transportation costs. Government incentives and tax credits for EVs are also driving this shift.

Financing and Leasing Trends

Financing and leasing trends are also evolving. High interest rates are making auto loans more expensive, prompting consumers to seek longer loan terms or consider leasing instead of buying. Leasing offers lower monthly payments.

- Longer Loan Terms: Spreading payments over more years to reduce monthly costs.

- Increased Leasing: Opting for leasing to avoid high upfront costs and benefit from lower monthly payments.

- Down Payment Strategies: Saving larger down payments to reduce loan amounts and interest.

Rising rates create economic problems for the consumer purchasing a vehicle. Rates are high and prices are also on the rise across the country.

In conclusion, consumer behavior is shifting drastically in response to the effects of inflation. These trends highlight the need for manufacturers and dealers to adapt to changing preferences and financial constraints.

Strategies for Consumers to Navigate the Inflated Market

Navigating the inflated automotive market requires consumers to be strategic. Careful planning and savvy decision-making can help mitigate the financial impact of high vehicle prices.

Thorough Research and Comparison Shopping

Before making a purchase, conduct thorough research and comparison shopping. Compare prices from multiple dealers and consider different makes and models and use Kelley Blue Book to get the most accurate reading on the price of a car.

Buyers should also look into financing rates. Financing rates directly impact how much you will pay in total for a vehicle.

Considering Used or Certified Pre-Owned Vehicles

Used or certified pre-owned (CPO) vehicles can offer significant savings compared to new cars. CPO vehicles often come with warranties and have undergone inspections to ensure their quality.

- Price Savings: Used cars are generally more affordable than new ones.

- Lower Depreciation: Used cars depreciate slower than new cars.

- Warranty Coverage: CPO vehicles often come with extended warranties.

Negotiating Tactics and Timing Purchases

Negotiating tactics and carefully timing purchases can also help. Look for end-of-year sales or take advantage of dealer incentives. Be prepared to negotiate the price, financing terms, and trade-in value of your current vehicle.

End of year sales can sometimes alleviate costs for vehicles given the need for dealers to empty their lots before the new year begins.

In conclusion, consumers can navigate the inflated automotive market by employing thorough research, considering used or CPO vehicles, and using effective negotiation tactics to make informed decisions.

Future Outlook: Inflation and the Automotive Market

The future of the automotive market is closely tied to the trajectory of inflation. Understanding potential scenarios and long-term trends is crucial for both consumers and industry stakeholders.

Potential Scenarios for Inflation

Several potential scenarios could unfold regarding inflation in the coming years, and they all have an impact on market outlook. These scenarios include persistent high inflation, a gradual return to normal rates, or even deflation.

Technological Advancements and Cost Reduction

Technological advancements and cost reduction strategies could also play a role in offsetting inflationary pressures. Innovations in manufacturing processes, battery technology, and autonomous driving systems might lower production costs and improve efficiency.

Long-Term Trends in Vehicle Ownership

Long-term trends in vehicle ownership may also shift in response to inflation and other factors. Shared mobility services, subscriptions, and alternative transportation options could become more popular, reducing the need for individual car ownership.

- Shared Mobility: Increased use of ride-sharing and car-sharing services.

- Subscription Models: Paying a monthly fee for access to a vehicle instead of buying it outright.

- Public Transport: Greater reliance on buses, trains, and other forms of public transportation.

In the years to come, it is more difficult to buy a vehicle, so it may be worth it to stick to owning older ones and repairing them in order to keep costs down.

Expert Opinions and Industry Forecasts

Expert opinions and industry forecasts provide valuable insights into the future of the automotive market amidst inflationary pressures. These perspectives can help consumers and investors make informed decisions.

Insights from Automotive Analysts

Automotive analysts offer a range of insights on the impact of inflation. Some predict a continued period of high prices. These experts are constantly looking at the automotive market to see what changes are on the way.

Predictions from Economists

Economists offer broader macroeconomic forecasts that influence the automotive market. Their predictions include interest rate trends, consumer spending patterns, and overall economic growth.

Strategies for Staying Informed

Staying informed about expert opinions and industry forecasts is critical. Follow reputable news sources, industry publications, and financial analysis reports to stay ahead of the curve.

- Follow Industry News Outlets: such as Automotive News, and industry-specific newsletters.

- Monitor Economic Indicators: Track inflation rates, interest rates, and consumer confidence indices.

- Consult Financial Advisors: Seek advice from financial professionals to navigate investment decisions.

In conclusion, expert opinions and industry forecasts provide a valuable information source. Keeping track of their ideas may allow you to predict what changes are coming in the automotive market.

| Key Point | Brief Description |

|---|---|

| 💰 Rising Prices | New and used car prices are increasing. |

| 💡 Strategic Buying | Research, compare, and negotiate to find deals. |

| 🚗 Used Options | Consider certified pre-owned vehicles for savings. |

| ⚡️ EVs | Explore fuel-efficient and electric vehicles. |

FAQ

▼

Inflation increases the cost of raw materials, labor, and manufacturing, leading to higher prices for the average new car as the automotive industry adapts to the new economic landscape.

▼

Yes, increased demand and limited new car production drive up the price of used cars and certified pre-owned vehicles. This is also due to a need for personal transportation.

▼

Consider used or CPO vehicles, negotiate prices, and buy the vehicle at the end of the year. You can also follow industry trends to possibly foresee a window of an advantageous purchase.

▼

Increased interest rates make auto loans more expensive, prompting buyers to seek longer loan terms or consider leasing. You can also shop around at local credit unions that may offer better deals.

▼

Leasing offers lower monthly payments, but buying builds equity. The decision depends on individual financial situations and long-term needs in this volatile market.

Conclusion

In conclusion, the impact of inflation on the automotive market: a deep dive reveals significant challenges and shifts in consumer behavior. By understanding these changes and employing strategic decision-making, consumers can navigate the automotive market effectively and make well-informed choices during times of economic uncertainty. The car market remains in flux because of inflation.