NHTSA’s New Rule: Impact on US Automakers’ 2027 Production

The new NHTSA rule, aiming to boost fuel efficiency and safety, is poised to significantly challenge US automakers by 2027, requiring substantial redesigns and production shifts toward electric vehicles and advanced safety features to avoid non-compliance penalties.

The automotive industry is no stranger to regulatory shifts, but the recent announcement of the new National Highway Traffic Safety Administration (NHTSA) rule has sent ripples through US automakers. This regulation, often seen as a critical step towards a greener and safer future, raises significant questions: New NHTSA Rule: How Will It Impact US Automakers’ Production by 2027? Understanding its nuances and projected consequences is vital for both manufacturers and consumers alike as the deadline approaches.

Understanding the New NHTSA Mandate and Its Objectives

The National Highway Traffic Safety Administration (NHTSA) has recently introduced a comprehensive set of regulations that are set to redefine the landscape of vehicle production in the United States. These rules are not merely minor adjustments; they represent a significant push towards enhancing vehicle safety, improving fuel economy, and reducing environmental impact. Automotive manufacturers are now tasked with the formidable challenge of integrating these new standards into their production cycles by the 2027 deadline.

At its core, the new NHTSA mandate aims to achieve several critical objectives. Firstly, it seeks to substantially increase the average fuel economy of new vehicles sold in the US, aligning with broader national goals for energy independence and reduced greenhouse gas emissions. This often translates into stricter Corporate Average Fuel Economy (CAFE) standards, pushing manufacturers to innovate in powertrain technology. Secondly, the mandate introduces new requirements for advanced safety features, moving beyond traditional passive safety systems to active technologies that can prevent accidents or mitigate their severity. This includes expanded deployment of technologies such as automatic emergency braking (AEB), lane-keeping assist, and enhanced crashworthiness standards.

The historical context of NHTSA regulations shows a continuous evolution, often driven by public safety concerns, technological advancements, and environmental imperatives. Previous mandates have led to innovations like airbags, anti-lock brakes, and electronic stability control becoming standard features. This latest rule builds on that legacy, looking forward to a future where vehicles are not only more efficient but also inherently safer, leveraging the rapid progress in sensor technology, artificial intelligence, and vehicle-to-everything (V2X) communication. The sheer scope of these updates means that a simple tweak to existing models will not suffice; a fundamental re-evaluation of design, engineering, and manufacturing processes will be necessary for compliance.

Key Pillars of the New Regulation

The new NHTSA rules are built upon several foundational pillars, each designed to address specific areas of concern within the automotive sector. These pillars collectively form the framework that US automakers must adhere to.

- 🚀 Fuel Efficiency: Stricter CAFE targets necessitating higher MPG ratings across vehicle fleets.

- 🛡️ Advanced Safety Features: Mandatory inclusion of preventative systems like AEB and enhanced blind-spot monitoring.

- ♻️ Emissions Reduction: Indirect impact through fuel efficiency, contributing to lower carbon footprints.

- 🛠️ Software Updates and Cybersecurity: Requirements for secure over-the-air (OTA) updates and robust cybersecurity protocols.

Evolving Regulatory Landscape

The regulatory environment for automakers is constantly evolving, influenced by technological advancements, environmental shifts, and societal demands. The new NHTSA rule is a prime example of this dynamic interplay, pushing the industry to accelerate its pace of innovation. As consumer preferences also shift towards safer and more sustainable transport, these regulations play a crucial role in shaping market offerings. This interplay between consumer demand, technological feasibility, and regulatory pressure creates a complex challenge for manufacturers.

In summary, the new NHTSA mandate is a multi-faceted regulation designed to usher in a new era of automotive manufacturing in the US. By focusing on enhanced fuel efficiency and advanced safety systems, it sets a high bar for automakers, requiring significant investment in research, development, and production transformation to meet the 2027 deadline.

Direct Impacts on US Automakers’ Production Lines

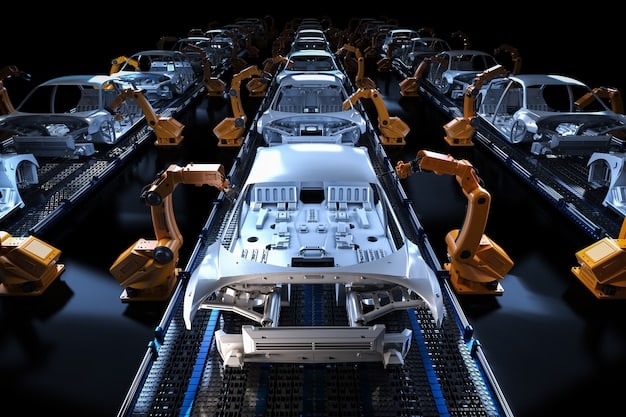

The implications of the new NHTSA rule extend far beyond theoretical discussions about safety and efficiency; they will directly reshape the production lines of US automakers. The 2027 deadline imposes a tight schedule for fundamental changes in vehicle design, component sourcing, and assembly processes. Manufacturers will need to invest heavily in retooling plants, training personnel, and overhauling their supply chains to accommodate the new requirements. This often means a complete redesign of vehicle platforms rather than incremental updates, especially for models that are far from meeting the new fuel economy and safety benchmarks.

One of the most significant direct impacts will be the accelerated shift towards electric vehicles (EVs) and hybrid technologies. Meeting stringent fuel efficiency standards with traditional internal combustion engine (ICE) vehicles is becoming increasingly difficult and costly. EVs, with their zero tailpipe emissions and higher energy efficiency ratings, offer a compelling pathway to compliance. This will necessitate a significant increase in EV production capacity, battery manufacturing, and the development of robust charging infrastructure. Automakers that have been slower to adopt electrification will feel a more acute pressure to catch up, potentially reallocating resources from ICE vehicle development to EV research and production.

Furthermore, the integration of advanced safety features will require sophisticated sensor arrays, powerful onboard computers, and complex software systems. This shifts the skillset required on the production floor, moving from purely mechanical assembly to a blend of mechanical, electrical, and software integration. Quality control processes will also need to evolve, focusing on the reliable operation of these interconnected safety systems. The sheer volume of new technology being introduced means that every stage of production, from initial design simulations to final vehicle testing, will be impacted, demanding greater precision and higher levels of automation.

Manufacturing Process Adjustments

Adapting to the new rules will involve substantial adjustments to existing manufacturing processes. These changes are not superficial; they penetrate deep into the core of how vehicles are built, leading to a ripple effect across the entire production ecosystem.

- ⚙️ Re-tooling Plants: Upgrading assembly lines to handle new materials and component integrations, particularly for EV architectures.

- 💻 Software and Hardware Integration: Developing robust processes for integrating complex sensing and control units into vehicles.

- 🔄 Supply Chain Revisions: Shifting procurement strategies to prioritize suppliers of EV components, advanced sensors, and specialized software.

Workforce Training and Development

The introduction of new technologies and methodologies demands a parallel evolution in the automotive workforce. Training programs will be essential to equip employees with the necessary skills to operate new machinery, manage complex software integrations, and maintain the advanced systems being incorporated into vehicles. This reskilling effort represents a significant investment but is critical for successful compliance.

In essence, the new NHTSA rule is driving an unprecedented transformation of automotive production lines in the US. It demands not just compliance, but a fundamental realignment of manufacturing strategies, technological priorities, and workforce development, preparing the industry for a future dominated by electrified, intelligent, and safer vehicles.

Challenges and Opportunities for Established Manufacturers

For established US automakers, the new NHTSA rule presents a complex duality: significant challenges intertwined with compelling opportunities. Companies like Ford, General Motors, and Stellantis, with their vast existing infrastructures and deeply entrenched production methodologies, face the monumental task of pivoting their operations without disrupting current market demands. The sheer scale of their current ICE vehicle production volume makes a swift transition complicated and costly. These manufacturers have long research and development cycles, extensive supply chains, and large workforces accustomed to traditional automotive engineering, making rapid adaptation a logistical and financial tightrope walk.

The primary challenge lies in the capital investment required. Re-tooling factories, developing new R&D capabilities for electric and autonomous technologies, and retraining thousands of employees demand billions of dollars. There’s also the risk of alienating a segment of their loyal customer base who might prefer traditional vehicles, or of not being able to ramp up new technology production fast enough to meet demand, ceding market share to nimble EV-first startups. Furthermore, regulatory compliance isn’t a one-time event; it necessitates continuous monitoring and adaptation as standards evolve, requiring a more agile and responsive corporate structure.

However, these challenges also unlock unparalleled opportunities. Established automakers possess immense brand recognition, extensive dealership networks, and decades of engineering expertise, particularly in large-scale manufacturing and safety. By successfully navigating this transition, they can solidify their leadership in the next generation of automotive technology. The push towards EVs and advanced safety features opens new revenue streams through software services, data analytics, and potentially even new business models like subscription-based features or mobility solutions. Early adopters who overcome the initial hurdles could gain a significant competitive advantage, strengthening their market position for decades to come.

Capital Investment and Resource Allocation

The financial burden of complying with the new NHTSA rule cannot be overstated. Automakers must carefully balance their budgets, allocating significant capital towards R&D for new powertrains, advanced safety systems, and manufacturing upgrades while also sustaining their current product lines.

- 💰 R&D Expenditure: Increased spending on battery technology, electric motor design, and AI-driven safety software.

- 🏭 Infrastructure Overhaul: Modernization of existing plants and construction of new facilities for EV production.

- 📈 Market Strategy Adjustments: Developing marketing and sales strategies to educate consumers on new vehicle benefits and overcome initial resistance.

Innovation and Market Leadership

For those willing to embrace the change, the new regulations are a catalyst for innovation. By leading the charge in electric vehicle technology and advanced safety, established automakers can redefine their brand image, attract new customer demographics, and reinforce their position as industry leaders. This proactive approach can transform a compliance burden into a competitive advantage.

In conclusion, established US automakers stand at a critical juncture. While the new NHTSA rule imposes substantial operational and financial pressures, it simultaneously offers a pathway to future relevance and market leadership through strategic innovation and investment in next-generation automotive technologies. The companies that successfully pivot will be the ones that thrive in the automotive landscape of 2027 and beyond.

Emerging Technologies and Their Role in Compliance

Meeting the stringent requirements of the new NHTSA rule will rely heavily on the rapid adoption and integration of emerging technologies. The mandate is not merely an incremental adjustment; it demands a transformative leap in vehicle capabilities, particularly in areas of fuel efficiency and safety. This translates into an accelerated timeline for technologies that were once considered futuristic but are now becoming essential for compliance. Automakers are looking towards a suite of innovations to bridge the gap between current production capabilities and future regulatory demands.

Electric vehicle battery technology is at the forefront of this technological shift. Advancements in energy density, charging speed, and cost reduction for batteries are critical for making EVs a viable alternative for a broader consumer base and for powering a larger share of manufacturer fleets to meet CAFE standards. Beyond the battery itself, the entire EV powertrain, including more efficient electric motors and sophisticated power management systems, is undergoing rapid development. These improvements are not just about raw performance but also about long-term reliability and environmental sustainability.

In the realm of safety, advanced driver-assistance systems (ADAS) are evolving at an unprecedented pace. The NHTSA rule will likely push for widespread adoption of Level 2 and potentially Level 3 autonomous driving features, requiring sophisticated sensor suites (radar, lidar, cameras), powerful AI processors, and highly accurate mapping data. The integration of vehicle-to-everything (V2X) communication is also gaining traction, enabling cars to “talk” to each other and to infrastructure, providing real-time data to prevent accidents before they occur. Cybersecurity is another critical emerging technology; as vehicles become more connected and software-defined, robust cybersecurity protocols are essential to protect against potential hacks and ensure the integrity of safety systems.

Key Technological Levers

Several key technological advancements are serving as the primary levers for automakers to meet the new NHTSA requirements. Each plays a vital role in pushing the boundaries of what is possible in vehicle design and functionality.

- 🔋 Next-Generation Battery Technology: Solid-state batteries offering higher energy density and faster charging.

- 🧠 Artificial Intelligence and Machine Learning: Enhancing ADAS capabilities, predictive maintenance, and autonomous functions.

- 📡 V2X Communication: Enabling real-time data exchange for improved traffic flow, accident prevention, and smart city integration.

Software-Defined Vehicles

The move towards software-defined vehicles (SDVs) is perhaps one of the most profound technological shifts impacting compliance. SDVs allow for features, safety updates, and even performance enhancements to be delivered wirelessly through over-the-air (OTA) updates. This capability is crucial for keeping vehicles compliant with evolving safety and emissions standards long after they leave the factory floor, offering flexibility and cost efficiency that traditional hardware-centric designs cannot match.

In conclusion, emerging technologies are not just aiding in NHTSA rule compliance; they are fundamentally redefining what a modern vehicle is. From advanced battery chemistry to sophisticated AI-powered safety systems and the paradigm shift toward software-defined architectures, these innovations are essential tools for US automakers to navigate the regulatory landscape and thrive in the automotive future.

Supply Chain Disruptions and Strategic Realignments

The new NHTSA rule will inevitably trigger significant disruptions and necessitate strategic realignments within the automotive supply chain. The shift towards electrificati, sophisticated safety features, and new materials will create unprecedented demand for certain components while potentially reducing demand for others. Automakers, already recovering from semiconductor shortages and global logistics challenges, now face another complex layer of supply chain management that requires meticulous planning and foresight to avoid future bottlenecks.

The most immediate impact will be on components related to electric powertrains and advanced safety systems. Batteries, electric motors, power electronics, semiconductors, and specialized sensors will see a surge in demand. This will place immense pressure on existing suppliers, many of whom may not have the capacity or technological expertise to meet the rapidly escalating requirements. Automakers will need to diversify their sourcing, invest in localized production, or forge new partnerships to secure critical materials and components, potentially leading to increased costs and longer lead times. Geopolitical factors also play a significant role, as many essential raw materials for EV batteries, like lithium and cobalt, are sourced from specific regions, introducing an element of risk and a need for resilient supply strategies.

Conversely, some traditional ICE-related components, such as exhaust systems, fuel injection components, and complex multi-speed transmissions, may experience a decline in demand. Suppliers specializing in these areas will need to pivot their operations, retool their factories, and retrain their workforce to adapt to the evolving market. This transition could lead to consolidation in the supply base, with smaller, less adaptable firms struggling to keep pace. Automakers will also look to rationalize their supplier networks, seeking partners who can offer vertically integrated solutions or who are themselves investing heavily in the future of electric and autonomous vehicle technology.

Reshaping Supplier Relationships

The relationship between automakers and their suppliers will evolve from transactional to more collaborative, especially for critical components. Joint ventures, long-term contracts, and shared R&D initiatives will become more common to ensure component availability and technological synergy.

- 🤝 Collaborative Ventures: Forming strategic alliances with key suppliers for shared development and production.

- 🌍 Localized Sourcing: Increasing domestic or regional sourcing to mitigate global supply chain risks.

- 📊 Supplier Diversification: Spreading risk by sourcing critical components from multiple vendors across different geographies.

Impact on Raw Material Sourcing

The push for EVs will drastically alter the demand for raw materials. Mining and processing capabilities for锂, nickel, cobalt, and rare earth elements will need to scale up significantly. Ethical sourcing and environmental concerns related to these materials will also become paramount, requiring greater transparency and responsible practices throughout the supply chain.

In essence, the new NHTSA rule is not just about car manufacturing; it’s about reshaping the entire ecosystem that supports it. US automakers must strategically realign their supply chains, fostering new partnerships and investing in resilient sourcing strategies to ensure they can meet production targets and regulatory demands by 2027.

Economic Implications and Consumer Choices by 2027

The economic ramifications of the new NHTSA rule are extensive, touching upon vehicle pricing, manufacturing costs, and ultimately, consumer choices by 2027. While the long-term benefits of safer and more fuel-efficient vehicles are clear, the immediate transition will introduce economic pressures that could reshape the automotive market. Automakers will incur substantial costs for research, development, re-tooling, and training, and a portion of these costs will inevitably be passed on to consumers, potentially leading to higher vehicle prices across various segments. This price increase could be particularly noticeable for vehicles in categories that previously enjoyed lower prices due to less stringent requirements.

However, the picture is not entirely bleak for consumers. While upfront costs might increase, the long-term savings from improved fuel economy, particularly for electric vehicles, could offset the initial investment. Lower operating costs due to fewer maintenance requirements for EVs and reduced fuel expenses could make ownership more attractive over the vehicle’s lifespan. Furthermore, government incentives, such as tax credits for EV purchases, might continue to play a crucial role in making these vehicles more accessible and palatable to a wider audience, helping to mitigate the impact of higher sticker prices. The increased availability of advanced safety features could also lead to lower insurance premiums over time, adding another layer of long-term economic benefit.

The rule will also steer consumer choices more decisively towards electric and hybrid vehicles by 2027. With fewer traditional ICE options on the market, or with ICE vehicles becoming significantly more expensive to comply with the rules, the range of available choices will shift. This “push” from regulation, combined with a “pull” from growing environmental awareness and technological appeal, will accelerate the market’s transition. Consumers will have to weigh the initial purchase price against the long-term operating costs, environmental benefits, and the enhanced safety provided by the new generation of vehicles. This shift will require considerable consumer education from automakers and dealerships to highlight the value proposition of these new compliance-driven vehicles.

Pricing Strategies and Market Segmentation

Automakers will innovate their pricing strategies, potentially offering a wider range of EV models at different price points to cater to diverse economic segments. The market may see a more pronounced segmentation between entry-level compliant vehicles and premium high-tech offerings.

- 💸 Cost-Benefit Analysis: Consumers will increasingly evaluate vehicles based on total cost of ownership rather than just purchase price.

- 🏷️ Incentive Reliance: Continued importance of federal and state incentives to drive adoption of compliant vehicles.

- 🎁 Value Proposition Redefinition: Automakers focusing marketing efforts on highlighting safety and efficiency benefits to justify price adjustments.

Long-Term Economic Outlook

Looking beyond 2027, the economic implications suggest a more sustainable and potentially more competitive US automotive industry. By investing now, automakers will be better positioned in the global market for green and safe transportation. The increased manufacturing of advanced components domestically could also boost economic activity and create new jobs.

In conclusion, the economic ripple effects of the new NHTSA rule will be felt acutely by 2027, influencing both the cost of vehicles and the choices consumers make. While the transition may bring short-term price increases, it also promises long-term savings and a more sustainable, safer automotive future, contingent on the effective interplay of industry innovation, government incentives, and informed consumer decisions.

Anticipating Regulatory Evolution Beyond 2027

While the immediate focus remains on the 2027 deadline for the new NHTSA rule, it is crucial for US automakers to anticipate that regulatory evolution will not halt there. The automotive industry operates in a perpetually changing environment, influenced by rapid technological advancements, shifting geopolitical landscapes, new scientific discoveries, and evolving societal expectations regarding safety and environmental impact. Therefore, the 2027 mandate should be viewed not as a finish line, but as a significant checkpoint in an ongoing journey towards more sustainable and safer transportation.

Looking beyond 2027, it is highly probable that future NHTSA regulations will continue to push the boundaries of vehicle safety and environmental performance. We can expect even more stringent CAFE standards, possibly leading to an accelerated timetable for the complete phase-out of traditional internal combustion engines in new vehicles. The emphasis on advanced driver-assistance systems (ADAS) will likely evolve into mandates for higher levels of autonomous driving, transitioning from assisted driving to fully automated capabilities under specific conditions. This will bring new regulatory challenges related to liability, data privacy, and the complex ethical considerations of AI decision-making in autonomous vehicles (AVs).

Furthermore, new areas of regulatory focus may emerge. Cybersecurity, already a growing concern, will become even more critical as vehicles become increasingly connected and software-dependent, requiring robust standards for data protection and system integrity. The lifecycle environmental impact of vehicles, from manufacturing processes to end-of-life recycling of batteries and composite materials, could also come under stricter scrutiny. Automakers that adopt a proactive stance, continuously investing in R&D and engaging in collaborative dialogues with regulators, will be better positioned to adapt to these changes, transform challenges into opportunities, and shape the future of mobility.

Future Regulatory Focus Areas

The next wave of automotive regulations is expected to broaden its scope, incorporating new technological and environmental considerations that will further pressure automakers to innovate.

- 📈 Higher Autonomy Levels: Moving beyond L2 ADAS to L3 and L4 autonomous driving mandates.

- 🔒 Enhanced Cybersecurity: Stricter requirements for vehicle software security and data protection.

- 🌱 Cradle-to-Grave Sustainability: Regulations addressing the environmental impact across the entire vehicle lifecycle, including production and recycling.

Proactive Industry Engagement

To navigate the complex future regulatory landscape, automakers must engage proactively with policymakers and industry groups. This involves contributing to the development of new standards, advocating for feasible implementation timelines, and sharing insights from real-world technological advancements. Such engagement fosters a more predictable regulatory environment and allows for industry-wide preparedness.

In essence, while the 2027 NHTSA rule marks a significant milestone, it is merely a precursor to an ever-evolving regulatory future. US automakers must cultivate a culture of continuous adaptation and innovation, anticipating the next wave of mandates to ensure long-term compliance, competitiveness, and leadership in the global automotive arena.

Strategic Responses and Diversification for US Automakers

In response to the new NHTSA rule and the broader trends it represents, US automakers are compelled to adopt strategic responses that go beyond mere compliance; they must embrace diversification. This involves not only transforming their vehicle lineups but also reimagining their business models, exploring new revenue streams, and fostering a culture of innovation that extends throughout their organizations. The traditional model of solely manufacturing and selling vehicles is evolving, replaced by a more comprehensive approach that encompasses mobility solutions, energy services, and advanced technology integration.

One key response is accelerated portfolio diversification towards electric and alternative fuel vehicles. Automakers are not just adding a few EV models; they are committing to entirely new platforms designed from the ground up for electrification, often introducing multiple EV variants across different segments, from compact cars to light trucks and SUVs. This push is complemented by investments in charging infrastructure and battery technology, sometimes through partnerships or direct acquisition of specialized companies. By offering a diverse range of clean vehicles, manufacturers can meet various consumer needs while simultaneously achieving compliance with fuel efficiency targets.

Beyond product diversification, there’s a strategic move towards services and software. As vehicles become more connected and intelligent, the opportunity to offer subscription-based services, over-the-air (OTA) updates, and data-driven insights becomes significant. This shift requires automakers to bolster their software development capabilities, potentially acquiring tech companies or hiring a new generation of software engineers. Diversifying into mobility services, such as ride-sharing fleets of autonomous vehicles or urban last-mile solutions, also represents a growth area. These strategies allow automakers to leverage their brand and manufacturing expertise in new ways, creating multiple revenue streams that are less reliant on traditional vehicle sales.

Reimagining Business Models

The automotive business model is undergoing a profound transformation. Focusing on customer experience, lifecycle value, and integrated services will be central to securing future profitability and market relevance.

- 🚗 Mobility as a Service (MaaS): Exploring new offerings like car-sharing, ride-hailing, and subscription vehicle services.

- ☁️ Data and Software Monetization: Developing platforms for in-vehicle infotainment, predictive maintenance, and personalized services.

- 🏭 Circular Economy Principles: Designing vehicles for easier recycling and reuse of components to reduce environmental impact and costs.

Building Strategic Partnerships

Collaboration will be key. Automakers are increasingly forming alliances with technology companies, energy providers, and even competitors to share the financial burden and accelerate the development of new technologies, crucial for surviving and thriving in the new regulatory environment.

In conclusion, US automakers’ strategic responses to the new NHTSA rule extend far beyond simply meeting a deadline. They involve a fundamental reimagining of products, business models, and partnerships, driving diversification into new technologies and services. This comprehensive approach is essential for ensuring their continued relevance, profitability, and leadership in the rapidly evolving automotive landscape.

| Key Point | Brief Description |

|---|---|

| 🚀 Production Shift | Automakers must heavily invest in EV and hybrid production, retooling plants and retraining staff. |

| 💡 Tech Integration | Mandatory advanced safety features require robust sensor, AI, and V2X communication integration. |

| 💰 Economic Impact | Higher vehicle upfront costs likely, balanced by long-term fuel savings and potential incentives. |

| ⛓️ Supply Chains | Significant realignment needed, emphasizing EV components and localized sourcing. |

Frequently Asked Questions

The primary goal of the new NHTSA rule is to significantly enhance vehicle safety and improve fuel efficiency across the US automotive fleet. It aims to reduce road accidents and fatalities through advanced safety features while simultaneously lowering greenhouse gas emissions and decreasing reliance on fossil fuels, aligning with broader national environmental and energy independence objectives.

The rule will accelerate the shift towards producing more electric vehicles (EVs) and hybrid models. Traditional internal combustion engine (ICE) vehicles will either become more expensive to meet efficiency standards or will be gradually phased out in certain segments. Automakers will likely focus on developing diverse EV lineups, ranging from compact cars to SUVs and trucks, to comply with the new mandates by 2027.

It is likely that initial vehicle prices may increase. Automakers face substantial costs for research, development, and re-tooling factories to incorporate new technologies and meet stricter standards. A portion of these expenses may be passed on to consumers. However, potential long-term savings through improved fuel economy and reduced maintenance, coupled with government incentives for EVs, might offset the initial higher purchase price.

Technology will play a pivotal role. Advanced battery chemistries, more efficient electric powertrains, sophisticated artificial intelligence for driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication will be crucial. Cybersecurity measures for connected vehicles are also paramount. These innovations are essential for achieving both the higher fuel efficiency and enhanced safety requirements mandated by the new rule.

Supply chains will undergo significant disruption and realignment. There will be increased demand for EV-specific components like batteries, electric motors, and power electronics, while demand for traditional ICE components may decrease. Automakers will need to diversify sourcing, invest in localized production, and form new partnerships to secure critical materials and components, ensuring resilience and reliability in the evolving automotive landscape.

Conclusion

The new NHTSA rule fundamentally reshapes the landscape for US automakers, presenting both a formidable challenge and an undeniable opportunity. By 2027, the industry will have undergone a significant transformation, driven by an imperative for greater safety and environmental responsibility. This regulatory shift demands substantial investment in electrification, advanced safety technologies, and a complete rethinking of production processes and supply chains. While the path to compliance involves considerable economic and operational hurdles, those automakers that strategically embrace innovation, diversify their offerings, and proactively engage with the evolving regulatory environment will not only meet the requirements but also emerge as leaders in the next era of mobility. The ultimate outcome by 2027 will be a safer, more efficient, and more sustainable automotive ecosystem for the United States, cementing a new standard for vehicles on our roads.