2025 Rebound: 9% Growth in US Auto Parts Manufacturing Projected

Examining the 2025 Rebound: A 9% Projected Growth in US Automotive Parts Manufacturing reveals a significant upturn for a critical sector of the American economy. This anticipated surge marks a pivotal moment, signaling robust recovery and expansion within the industry.

Understanding the 2025 Growth Projection

The US automotive parts manufacturing sector is bracing for a substantial comeback, with analysts projecting a notable 9% growth in 2025. This forecast, based on comprehensive market analysis and economic indicators, highlights a renewed optimism and strategic shifts within the industry. The anticipated expansion is not merely a recovery from recent challenges but a forward-looking trajectory driven by innovative technologies and evolving consumer demands.

This projected growth reflects a multifaceted landscape where domestic production is gaining momentum. Factors such as increased demand for new vehicles, the push towards electric vehicles (EVs), and a strategic effort to reshore supply chains are playing crucial roles. Industry stakeholders are closely monitoring these developments, understanding that a 9% rise signifies significant investment opportunities and job creation across the nation.

Key Drivers Behind the Surge

Several critical factors are converging to fuel this optimistic outlook for US automotive parts manufacturing. The overarching trend points towards a more resilient and technologically advanced industry.

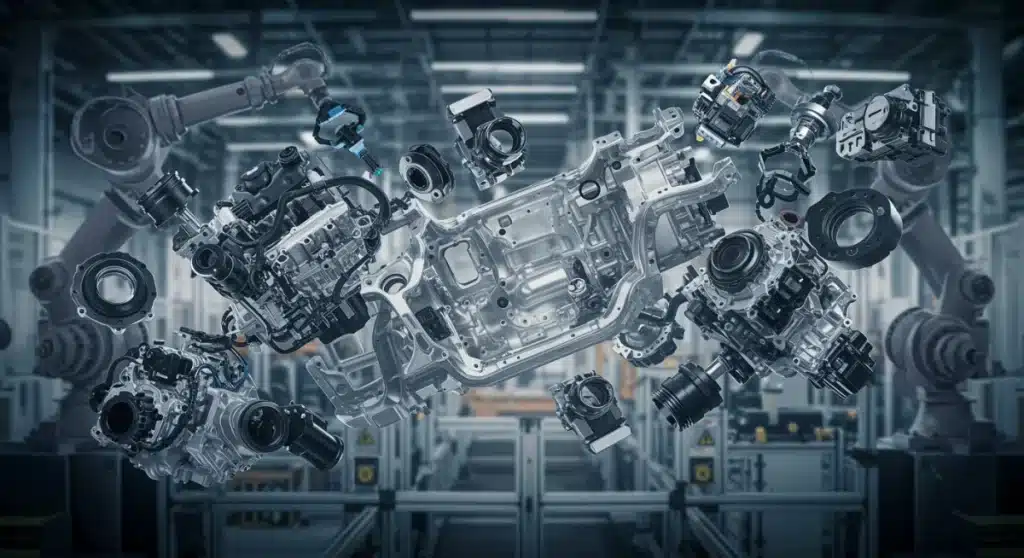

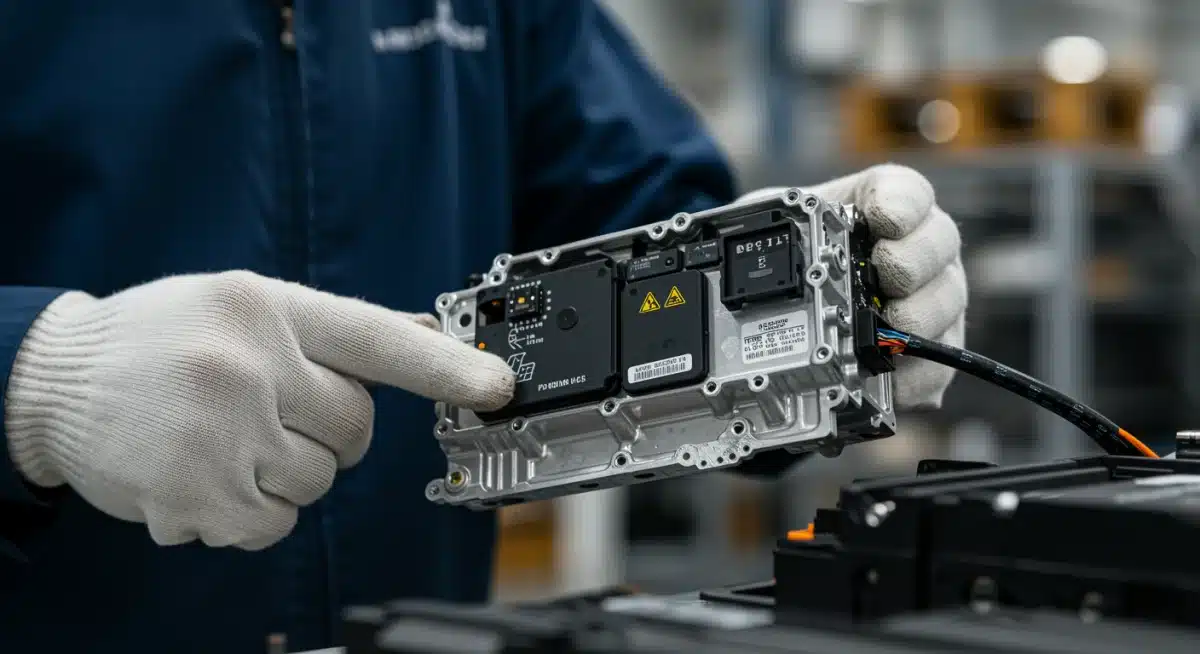

- Electric Vehicle (EV) Transition: The escalating global shift towards EVs necessitates entirely new component sets, from specialized batteries and electric motors to advanced power electronics. US manufacturers are investing heavily to meet this burgeoning demand.

- Supply Chain Reshoring: Geopolitical tensions and past supply chain disruptions have prompted a strategic move to bring manufacturing back to the US, reducing reliance on overseas production and enhancing domestic control.

- Technological Advancements: Continuous innovation in materials science, automation, and digital manufacturing processes is boosting efficiency and enabling the production of more sophisticated components domestically.

- Government Incentives: Federal and state initiatives, including tax credits and investment programs, are actively encouraging domestic automotive manufacturing and research & development.

Impact on the US Economy and Job Market

A 9% projected growth in US automotive parts manufacturing for 2025 is expected to have a profound and positive ripple effect across the broader US economy. This expansion is not confined to the manufacturing plants themselves; it stimulates growth in adjacent sectors, from raw materials suppliers to logistics and technology services. The direct economic benefit will be substantial, contributing to the nation’s Gross Domestic Product (GDP) and bolstering industrial output.

Furthermore, the job market stands to gain significantly. Increased production capacity and the development of new technologies will necessitate a larger, more skilled workforce. This will lead to job creation in engineering, skilled trades, research and development, and various support roles. Communities with established manufacturing bases are particularly poised to experience revitalized economic activity and enhanced employment opportunities. The demand for specialized skills will also drive educational and vocational training programs, ensuring a future-ready workforce.

Technological Innovations Driving Production

The anticipated surge in US automotive parts manufacturing is inextricably linked to continuous technological innovation. Manufacturers are increasingly adopting cutting-edge processes and materials to produce components that are lighter, more durable, and more efficient. This includes advancements in additive manufacturing, often known as 3D printing, which allows for rapid prototyping and the production of complex, customized parts with minimal waste. Robotics and automation are also transforming factory floors, enhancing precision, speed, and safety in assembly lines.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into manufacturing processes is optimizing production schedules, predicting equipment maintenance needs, and improving quality control. These smart factory initiatives are not just about efficiency; they are about creating a more adaptive and responsive manufacturing ecosystem capable of meeting dynamic market demands. The focus on sustainable manufacturing practices, including the use of recycled materials and energy-efficient processes, is also shaping the future of auto parts production.

Challenges and Opportunities in the Rebound

While the outlook for a 9% projected growth in US automotive parts manufacturing in 2025 is largely positive, the industry is not without its challenges. Navigating these obstacles effectively will be crucial for realizing the full potential of this rebound. Workforce development remains a key concern, as the demand for highly skilled labor in advanced manufacturing outpaces the current supply. Companies must invest in training and upskilling programs to ensure they have the talent necessary to operate sophisticated machinery and manage complex production processes.

Navigating Supply Chain Complexities

Despite efforts to reshore, global supply chain vulnerabilities persist. Manufacturers must continue to diversify their supplier base and build greater resilience into their logistics networks. This involves strategic partnerships and investments in domestic raw material sourcing. The transition to electric vehicles also presents a unique set of supply chain challenges, particularly concerning the availability and cost of critical minerals for battery production.

- Raw Material Volatility: Fluctuations in the price and availability of critical materials like lithium, cobalt, and rare earth elements can impact production costs and timelines.

- Logistics and Infrastructure: Ensuring efficient transportation and robust infrastructure for new manufacturing hubs is essential for timely delivery of parts.

- Regulatory Compliance: Adhering to evolving environmental and trade regulations adds layers of complexity to international and domestic operations.

However, these challenges also present significant opportunities for innovation and strategic advantage. Companies that can effectively address these issues will emerge stronger and more competitive in the long run. The drive towards sustainability, for instance, encourages the development of closed-loop recycling systems and the exploration of alternative materials, fostering a more circular economy within the automotive sector.

Government Policies and Industry Support

Government policies are playing a pivotal role in fostering the anticipated 9% projected growth in US automotive parts manufacturing. Federal and state governments are implementing a range of initiatives designed to incentivize domestic production, encourage technological innovation, and strengthen the overall competitiveness of the US auto industry. These policies often come in the form of tax credits for manufacturing investments, grants for research and development, and funding for workforce training programs.

One significant area of focus is support for electric vehicle component production. The Bipartisan Infrastructure Law, for example, allocates substantial funding towards building out a domestic EV supply chain, including battery manufacturing and charging infrastructure. Furthermore, trade policies are being recalibrated to protect domestic industries and promote fair competition, which indirectly benefits US parts manufacturers by creating a more level playing field. Industry associations are also actively advocating for policies that support their members, providing crucial feedback to policymakers and helping to shape the regulatory landscape.

Future Outlook and Long-Term Sustainability

The 9% projected growth in US automotive parts manufacturing in 2025 is more than just a short-term rebound; it represents a foundational shift towards a more resilient, innovative, and sustainable industry. Looking beyond 2025, the long-term outlook is characterized by continued investment in advanced manufacturing techniques, a deepening commitment to electrification, and an increasing focus on circular economy principles. Manufacturers are exploring new business models, such as parts-as-a-service and advanced remanufacturing, to extend product lifecycles and reduce environmental impact.

The industry’s ability to adapt to rapid technological change, particularly in areas like autonomous driving and connected car technologies, will be crucial for sustained growth. This necessitates ongoing collaboration between manufacturers, technology providers, and academic institutions to drive R&D and ensure a pipeline of skilled talent. The emphasis on cybersecurity in automotive components will also grow, as vehicles become increasingly integrated with digital systems. Ultimately, the future of US automotive industry manufacturing hinges on its capacity for innovation, its commitment to sustainability, and its agility in responding to evolving global market dynamics.

| Key Point | Brief Description |

|---|---|

| 2025 Growth Projection | US automotive parts manufacturing is projected to grow by 9%, signaling a strong rebound and expansion. |

| Key Growth Drivers | EV transition, supply chain reshoring, technological advancements, and government incentives are fueling growth. |

| Economic & Job Impact | Significant contributions to GDP, job creation in skilled trades, engineering, and R&D roles are anticipated. |

| Challenges & Opportunities | Workforce development and supply chain complexities present challenges but also drive innovation. |

Frequently Asked Questions About Auto Parts Manufacturing Growth

The US automotive parts manufacturing sector is projected to experience a significant 9% growth in 2025. This forecast indicates a robust rebound and expansion within the industry, driven by various market forces and strategic initiatives.

Key drivers include the accelerating transition to electric vehicles (EVs), concerted efforts to reshore supply chains, continuous technological advancements in production, and supportive government incentives aimed at bolstering domestic manufacturing capabilities.

The projected growth is expected to significantly boost the US GDP and create numerous job opportunities. This includes roles in engineering, skilled trades, and research and development, revitalizing local economies and enhancing employment across the nation.

Technological innovations such as additive manufacturing (3D printing), advanced robotics, automation, and the integration of AI and machine learning are enhancing production efficiency, precision, and the overall quality of automotive components.

Despite the optimistic projections, challenges remain, primarily in workforce development and persistent global supply chain complexities. Addressing these issues through training and strategic diversification will be crucial for sustained success and competitiveness.

What Happens Next

The projected 9% growth in US automotive parts manufacturing for 2025 sets the stage for a transformative period. Industry observers will be closely watching how manufacturers adapt to the escalating demand for EV components and how effectively supply chain reshoring initiatives mature. The ongoing development of a skilled workforce remains paramount, with educational institutions and vocational programs needing to align with industry needs. Further government policy adjustments and international trade dynamics will also shape the trajectory of this vital sector. The coming months will provide clearer insights into the execution of these strategic shifts and their broader implications for the American industrial landscape.