2025 Forecast: Raw Material Costs Hike US Vehicle Prices 8%

Rising raw material costs are projected to drive an 8% increase in US vehicle prices by 2025, significantly impacting consumer affordability and the automotive industry’s financial landscape.

The 2025 Forecast: How Rising Raw Material Costs Will Affect US Vehicle Prices by 8% (FINANCIAL IMPACT) is shaping today’s agenda with new details emerging from industry analysts and economic reports. This update prioritizes what changed, why it matters, and what to watch next, in a clear news format. The automotive sector is bracing for significant shifts, directly impacting consumers across the United States.

Understanding the Raw Material Cost Surge

The global economy has been grappling with supply chain disruptions and inflationary pressures, directly contributing to the escalating prices of critical raw materials. For the automotive industry, this surge is not a fleeting issue but a persistent challenge that is fundamentally reshaping production costs and, consequently, vehicle prices.

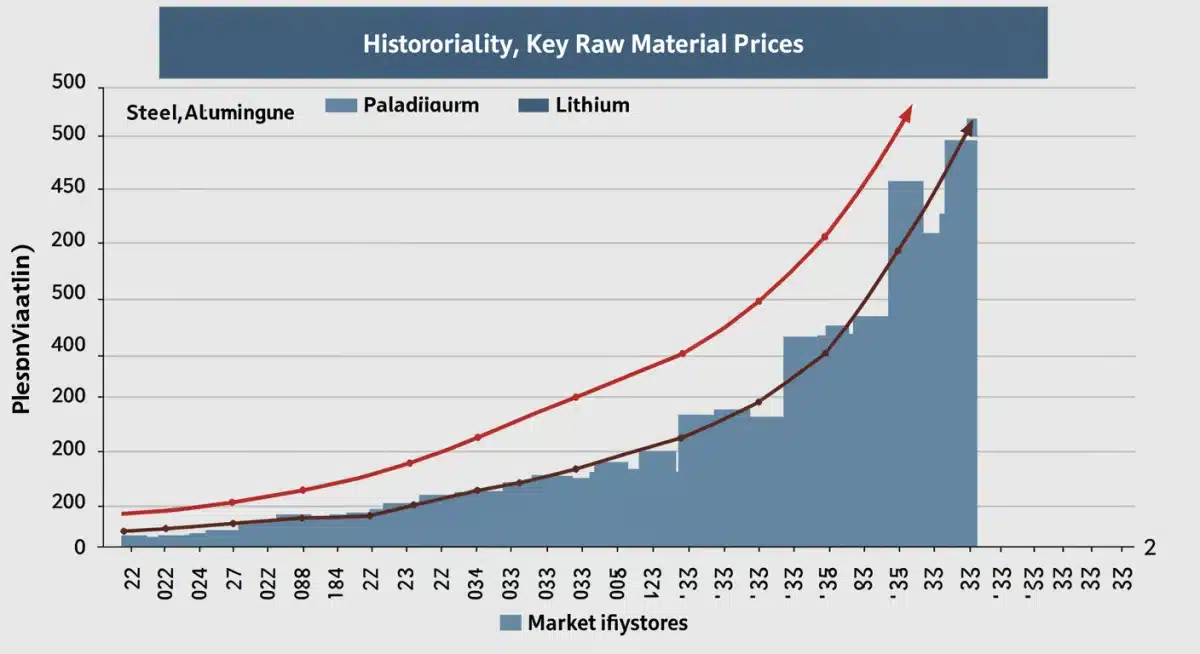

Key materials such as steel, aluminum, copper, and especially precious metals like palladium and rhodium, have seen dramatic price increases. Furthermore, the burgeoning demand for electric vehicles (EVs) has pushed up the costs of battery components like lithium, cobalt, and nickel, creating a ripple effect across the entire manufacturing landscape.

Factors Driving Material Price Increases

- Supply Chain Disruptions: Geopolitical tensions, labor shortages, and logistical bottlenecks continue to impede the smooth flow of raw materials from mines to factories.

- Increased Demand: The global push for electrification, coupled with a rebound in vehicle sales post-pandemic, has created unprecedented demand for specific materials, particularly those used in EV batteries.

- Inflationary Pressures: Broad economic inflation, driven by factors such as government spending and energy price hikes, contributes to higher operational costs for mining and processing raw materials.

Ultimately, these factors converge to create an environment where the cost of producing a single vehicle steadily climbs, forcing manufacturers to adjust their pricing strategies to maintain profitability. The impact is not uniform, with certain vehicle segments and technologies feeling a more pronounced squeeze.

The Direct Impact on Vehicle Manufacturing

Automakers operate on thin margins, and even slight fluctuations in raw material prices can significantly affect their bottom line. The current scenario, characterized by substantial and sustained increases, is forcing manufacturers to reassess every aspect of their production processes, from sourcing to assembly.

For example, the average car contains over a ton of steel, hundreds of pounds of aluminum, and various other metals. A 20% increase in steel prices, therefore, translates into a substantial added cost per vehicle. This is compounded by the rising costs of semiconductors, which remain in high demand and short supply, further exacerbating production expenses.

Manufacturer Responses to Rising Costs

- Supplier Negotiations: Automakers are engaging in aggressive negotiations with their suppliers to secure better pricing and long-term contracts for raw materials, often in exchange for guaranteed volume.

- Material Substitution: Research and development efforts are intensifying to find alternative, more affordable materials that can meet performance and safety standards without compromising quality.

- Design Optimization: Engineers are exploring ways to reduce the quantity of high-cost materials needed in vehicle designs, without impacting structural integrity or functionality.

These internal adjustments are crucial for mitigating some of the cost pressures. However, the sheer scale of the increases means that not all costs can be absorbed internally, leading inevitably to higher retail prices for consumers. The financial strain on manufacturers is palpable, as they strive to balance innovation, quality, and affordability in a challenging economic climate.

Projected 8% Increase in US Vehicle Prices by 2025

Industry analysts and economic models now project that the sustained rise in raw material costs will translate into an average 8% increase in new vehicle prices across the US market by 2025. This forecast is based on current trends in commodity markets, anticipated demand, and the lag time for these costs to fully propagate through the supply chain to the consumer.

An 8% increase, while appearing modest at first glance, represents thousands of dollars on the sticker price of a new car. For a vehicle costing $40,000, this means an additional $3,200, making new cars less accessible for many American households. The impact is particularly acute for lower and middle-income buyers, who may find themselves priced out of the new vehicle market.

Segments Most Affected by Price Hikes

While the increase is projected to be an average, certain vehicle segments are likely to experience more significant price adjustments. Electric vehicles, due to their heavy reliance on expensive battery materials like lithium, nickel, and cobalt, are particularly vulnerable. As demand for EVs continues to grow, so does the competition for these finite resources, pushing their prices even higher.

Luxury vehicles and models with advanced technology features, which often incorporate rare earth elements and sophisticated electronic components, will also see substantial price increases. Even budget-friendly segments will not be spared, as the fundamental costs of steel and aluminum impact all vehicle types.

The projected 8% increase is not just a number; it reflects a fundamental shift in the economics of car ownership in the US. Consumers will face tougher choices, potentially extending the lifespan of their current vehicles or opting for used cars, which in turn could put upward pressure on the used car market.

Consumer Impact and Affordability Concerns

The anticipated 8% increase in US vehicle prices by 2025 poses significant challenges for consumers, directly impacting their purchasing power and overall affordability. For many Americans, a new vehicle is a necessity, not a luxury, and a substantial price hike can strain household budgets already stretched by inflation in other sectors.

This increase will likely lead to higher monthly payments, even with favorable interest rates, or require larger down payments, creating financial barriers for prospective buyers. The ripple effect extends beyond the initial purchase, influencing insurance costs, financing options, and even the resale value of vehicles.

Strategies Consumers May Adopt

- Delaying Purchases: Many consumers might postpone buying new vehicles, opting to keep their current cars longer to avoid the higher costs.

- Exploring Used Car Market: Increased demand for used vehicles could lead to price inflation in that segment, making affordable options scarcer.

- Downgrading Vehicle Choices: Consumers might choose less expensive models, fewer optional features, or smaller vehicles to stay within their budget.

- Considering Alternative Transportation: For some, particularly in urban areas, the rising cost of car ownership might accelerate a shift towards public transport, ride-sharing, or electric bikes.

Automakers and dealerships will need to adapt to these changing consumer behaviors, potentially offering more flexible financing options, promoting certified pre-owned vehicles, or emphasizing the long-term value and fuel efficiency of their models to offset the higher upfront costs. The pressure on affordability is a critical concern, shaping market dynamics for years to come.

Government and Industry Responses

Recognizing the profound implications of rising raw material costs, both government bodies and industry associations are exploring various strategies to mitigate the impact. These responses range from policy interventions to collaborative industry initiatives, all aimed at stabilizing the market and supporting both manufacturers and consumers.

Government actions could include investing in domestic raw material extraction and processing to reduce reliance on volatile international markets, offering tax incentives for sustainable material sourcing, or even providing subsidies for consumers purchasing certain types of vehicles. These measures aim to ease the financial burden and promote a more stable automotive sector.

Key Industry Initiatives

- Supply Chain Diversification: Automakers are actively working to diversify their raw material supply chains, reducing dependence on single regions or suppliers to enhance resilience against future disruptions.

- Recycling and Circular Economy: Increased investment in recycling technologies for materials like lithium and rare earth elements aims to create a more sustainable and cost-effective supply of crucial components.

- Technological Innovation: Continued R&D into new materials and manufacturing processes that are less reliant on high-cost raw materials, or which can use them more efficiently, is a priority.

Collaboration between industry stakeholders, including automakers, suppliers, and research institutions, is also vital. Sharing best practices, pooling resources for research, and advocating for supportive government policies can collectively address the systemic challenges posed by rising raw material costs. These proactive steps are essential for navigating the complex economic landscape of the coming years.

Long-Term Outlook and Market Adaptation

Looking beyond 2025, the automotive industry faces a period of continuous adaptation to the evolving landscape of raw material costs. While the immediate forecast points to an 8% price increase, the long-term outlook will depend on a confluence of technological advancements, geopolitical stability, and market forces. The industry’s ability to innovate and diversify will be paramount.

The shift towards electric vehicles, while initially contributing to higher material costs, also presents opportunities for long-term sustainability through battery recycling and the development of next-generation battery chemistries that require fewer rare and expensive elements. Furthermore, advancements in manufacturing techniques, such as additive manufacturing (3D printing), could potentially reduce material waste and optimize usage.

The market will likely see a continued emphasis on vehicle efficiency and durability, as consumers seek to maximize the value of their increasingly expensive investments. This could accelerate the adoption of lighter materials, more aerodynamic designs, and powertrain technologies that offer superior fuel economy or electric range.

Ultimately, the long-term health of the US automotive market hinges on its capacity to absorb these cost pressures through innovation, strategic sourcing, and a commitment to providing value to consumers. The challenges are significant, but so too are the opportunities for transformation and growth within a more sustainable and resilient framework.

Key Aspect |

Brief Description > |

|---|---|

Price Increase |

US vehicle prices projected to rise by 8% by 2025 due to raw material costs. |

Driving Factors |

Supply chain disruptions, increased EV demand, and global inflation affecting material costs. |

Consumer Impact |

Reduced affordability, higher monthly payments, potential shift to used cars. |

Industry Adaptation |

Diversifying supply chains, material substitution, recycling, and technological innovation. |

Frequently Asked Questions About Vehicle Price Increases

The main driver is the sustained rise in raw material costs, including metals like steel, aluminum, copper, and critical battery components such as lithium and cobalt, exacerbated by supply chain issues and increased demand for electric vehicles.

Electric vehicles (EVs) are expected to see significant impacts due to their reliance on expensive battery materials. Luxury vehicles and models incorporating advanced technologies will also experience notable increases, though all segments will feel the pressure.

Consumers will likely face higher sticker prices, leading to increased monthly payments or larger down payments. This may push some buyers towards the used car market, delay purchases, or opt for more affordable vehicle segments.

Automakers are focusing on supply chain diversification, exploring material substitution, optimizing vehicle designs to reduce high-cost material usage, and investing in recycling programs for critical components.

Governments may consider investing in domestic raw material production, offering tax incentives for sustainable sourcing, or providing consumer subsidies for certain vehicle types to help stabilize the market and alleviate financial pressure on buyers.

What this means

The projected 8% increase in US vehicle prices by 2025 underscores a pivotal period for the automotive sector and consumers alike. This financial impact necessitates vigilance from both industry leaders and policymakers to foster resilience and innovation. Consumers should anticipate market shifts and plan their vehicle purchases strategically, while the industry continues to adapt to an era of heightened material costs and evolving supply chain dynamics. The coming years will reveal how effectively these challenges are met, shaping the future of mobility in the United States.