2025 Global Chip Shortage: US Auto Industry Economic Update

The 2025 global chip shortage continues to reshape the US auto industry, necessitating robust economic updates and strategic mitigation efforts to ensure production stability and address ongoing supply chain vulnerabilities.

The automotive world is once again bracing for significant challenges as the specter of a 2025 global chip shortage looms large. This critical situation demands an immediate economic update and a deep dive into the mitigation strategies being deployed by the US auto industry to navigate these turbulent waters.

Understanding the 2025 Global Chip Shortage Dynamics

The anticipated 2025 global chip shortage stems from a complex interplay of increased demand, geopolitical tensions, and an inelastic supply chain. Recent reports indicate that while some sectors have seen marginal recovery, the automotive industry remains particularly vulnerable due to its reliance on older, larger-node semiconductors and specialized chips.

As of late May 2024, industry analysts from Gartner and Deloitte highlight that lead times for certain automotive-grade microcontrollers are still extended, signaling persistent supply constraints into the mid-decade. Automakers are actively recalibrating their production schedules and procurement strategies to adapt to this evolving landscape.

Key Factors Driving the Shortage

Several factors converge to create this ongoing challenge, impacting everything from vehicle features to overall production volume. Understanding these drivers is crucial for developing effective responses.

- Legacy Chip Dependence: Many automotive systems rely on mature node chips, which are not prioritized by manufacturers focusing on cutting-edge consumer electronics.

- Geopolitical Instability: Tensions in key manufacturing regions can disrupt supply lines and raw material access, exacerbating existing vulnerabilities.

- Increased Vehicle Complexity: Modern vehicles integrate more electronic components than ever before, dramatically increasing the demand for diverse types of semiconductors.

- Inventory Depletion: The initial COVID-19 related shutdowns depleted existing chip inventories, leaving little buffer for subsequent disruptions.

Economic Impact on the US Auto Industry

The economic repercussions of the 2025 global chip shortage on the US auto industry are projected to be substantial, affecting production volumes, revenue projections, and employment. Automakers have already experienced billions in lost revenue due to previous shortages, and 2025 threatens to extend these financial pressures.

According to the Alliance for Automotive Innovation, the cumulative impact of chip shortages since 2020 has resulted in millions of fewer vehicles produced. This reduction in output directly translates to lower sales, reduced profits for manufacturers, and significant challenges for dealerships and the broader automotive ecosystem.

Revenue Loss and Production Cuts

The most immediate and visible impact is seen in the direct financial losses and production curtailments across major US automakers. Companies are forced to prioritize higher-margin models or cease production of certain vehicles entirely.

- Reduced Vehicle Availability: Fewer new cars on lots mean consumers face limited choices and potentially higher prices.

- Supply Chain Disruptions: The shortage creates ripple effects through the entire supply chain, impacting parts suppliers and logistics companies.

- Investment Delays: Some automakers are deferring investments in new technologies or production expansions due to uncertainty in chip supply.

- Job Market Instability: Production slowdowns can lead to temporary layoffs or reduced hours for factory workers, impacting local economies.

Current Mitigation Strategies by Automakers

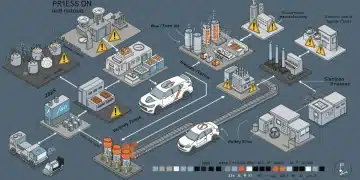

In response to the persistent threat of the 2025 global chip shortage, US automakers are implementing a range of proactive and reactive mitigation strategies. These efforts aim to secure future chip supplies, diversify sourcing, and redesign vehicles to optimize chip usage.

Ford, General Motors, and Stellantis have all announced initiatives to work more closely with semiconductor manufacturers, often entering into direct partnerships or exploring long-term supply agreements. This paradigm shift from indirect procurement through Tier 1 suppliers marks a significant change in industry practice.

Diversifying Supply Chains and Redesign

Automakers are not only focusing on securing existing chip types but also on fundamental changes to their vehicle architectures and supply networks.

This includes exploring alternative providers and even simplifying designs where possible to reduce the number of unique chips required per vehicle. The move towards modular platforms also aids in this flexibility.

- Direct Supplier Engagements: Establishing direct relationships with chip foundries to ensure prioritized allocation of automotive-grade semiconductors.

- Regionalization of Production: Investing in domestic or near-shore chip manufacturing capabilities to reduce reliance on distant supply chains.

- Vehicle Redesign for Flexibility: Developing vehicle platforms that can accommodate different types of chips or fewer chips, reducing dependency on specific components.

- Buffer Stockpiling: Strategically building up inventories of critical chips when supply allows, to cushion against future disruptions.

Governmental and Industry Collaborative Efforts

Recognizing the national security and economic implications of the 2025 global chip shortage, both the US government and industry consortiums are actively engaged in collaborative efforts. These initiatives aim to bolster domestic semiconductor production and foster a more resilient supply chain.

The CHIPS and Science Act, passed in 2022, provides significant funding to incentivize semiconductor manufacturing and research within the United States. This legislation is a cornerstone of the long-term strategy to reduce external dependencies and strengthen the nation’s technological infrastructure.

Policy and Investment Initiatives

Governmental policies are playing a crucial role in shaping the future of chip supply for the auto sector. These policies are designed to create a more favorable environment for domestic production.

This includes tax incentives, research grants, and streamlined regulatory processes to accelerate the establishment of new fabrication plants. The goal is to build a robust domestic ecosystem that can meet future demand.

- CHIPS Act Funding: Direct investments and subsidies for companies building or expanding semiconductor manufacturing facilities in the US.

- Industry Partnerships: Formation of alliances between automakers, chip manufacturers, and government agencies to share information and coordinate strategies.

- Workforce Development: Programs aimed at training a skilled workforce for the growing domestic semiconductor industry.

- Research and Development: Funding for innovation in chip design and manufacturing processes to enhance efficiency and reduce costs.

Technological Innovations and Future Outlook

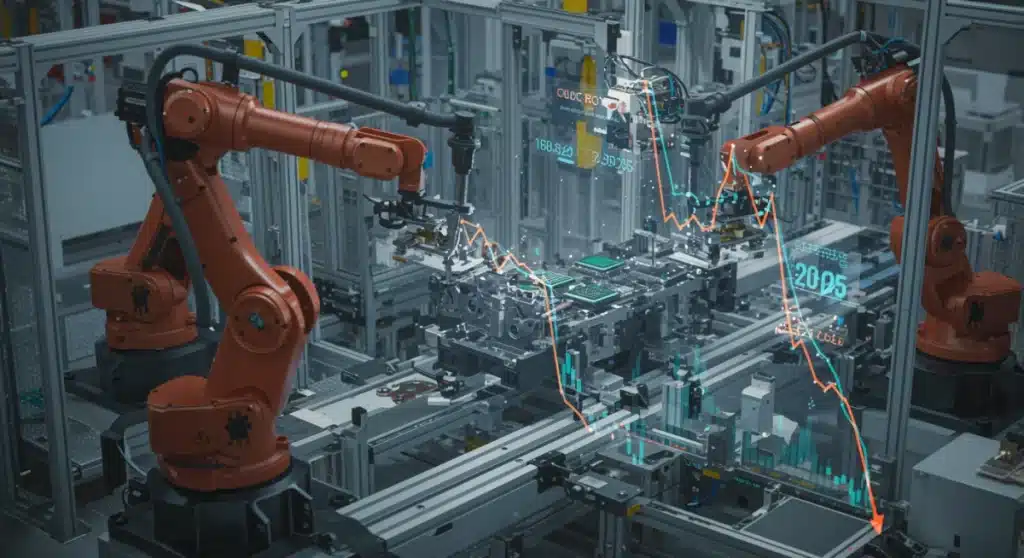

Beyond immediate mitigation, the 2025 global chip shortage is spurring significant technological innovations within the automotive sector. Companies are exploring new approaches to chip design, software-defined vehicles, and alternative materials to reduce vulnerability.

The shift towards software-defined vehicles (SDVs) is particularly relevant, as it allows for greater flexibility in hardware components and enables over-the-air updates, potentially extending the lifespan and functionality of existing chips. This also means a consolidation of electronic control units (ECUs), reducing the total number of chips needed.

![]()

Advanced Design and Consolidation

Automakers are increasingly looking at integrating more functions onto fewer, more powerful chips. This consolidation not only simplifies the Bill of Materials but also reduces the overall demand for a wide variety of specialized chips.

Furthermore, advancements in packaging technologies and heterogeneous integration allow for combining different chip types into a single package, optimizing space and performance while potentially easing supply chain pressures for individual components.

- Software-Defined Architecture: Designing vehicles where software dictates functionality, allowing for more adaptable hardware solutions.

- Chip Consolidation: Moving from a distributed network of many small chips to a centralized architecture with fewer, more powerful System-on-Chips (SoCs).

- New Material Exploration: Research into alternative semiconductor materials that may be less susceptible to supply chain bottlenecks.

- Advanced Packaging: Innovations in how chips are packaged and integrated, making them more resilient and versatile.

Long-Term Resilience and Strategic Preparedness

The lessons learned from the ongoing chip shortages are fundamentally reshaping the long-term strategies of the US auto industry. The focus is shifting from just-in-time inventory to a more resilient, strategically prepared approach that can withstand future global disruptions.

This involves not only technological and procurement changes but also a cultural shift within organizations to prioritize supply chain visibility and risk management. The goal is to build a robust ecosystem that minimizes exposure to single points of failure, ensuring sustained production and innovation.

Building a Robust Supply Ecosystem

Achieving long-term resilience requires a multi-faceted approach, encompassing everything from supplier relationships to internal operational adjustments. This strategic preparedness is critical for the industry’s future.

Automakers are investing in sophisticated analytics and AI tools to better predict potential supply chain disruptions and react swiftly. This proactive stance is becoming the new standard for managing complex global supply networks.

- Enhanced Supply Chain Visibility: Implementing advanced tracking and data analytics to monitor chip inventories and production across the entire supply chain.

- Strategic Partnerships: Forming deeper, more collaborative relationships with key suppliers, including long-term contracts and joint ventures.

- Reshoring and Nearshoring: Exploring opportunities to bring critical manufacturing processes closer to home to reduce logistical risks.

- Risk Management Frameworks: Developing comprehensive plans to identify, assess, and mitigate various supply chain risks, including geopolitical and natural disaster impacts.

| Key Point | Brief Description |

|---|---|

| 2025 Shortage Outlook | Persistent supply constraints for automotive-grade chips are expected to continue into 2025, driven by demand, geopolitics, and legacy chip reliance. |

| Economic Impact | US auto industry faces significant revenue losses and production cuts, impacting sales, profits, and employment due to reduced vehicle availability. |

| Mitigation Strategies | Automakers are diversifying supply chains, engaging directly with chip manufacturers, and redesigning vehicles for chip flexibility. |

| Governmental Support | The CHIPS and Science Act and industry collaborations aim to boost domestic semiconductor production and build supply chain resilience. |

Frequently Asked Questions About the 2025 Chip Shortage

The primary cause is a combination of surging demand for semiconductors across all sectors, geopolitical tensions affecting supply, and the automotive industry’s specific reliance on legacy chips, which are not prioritized by leading manufacturers.

US automakers are implementing strategies such as direct engagement with chip suppliers, diversifying their supply chains, redesigning vehicle architectures for chip flexibility, and strategically stockpiling critical components to ensure production continuity.

The US government, through initiatives like the CHIPS and Science Act, provides significant funding and incentives to boost domestic semiconductor manufacturing, reduce foreign reliance, and strengthen the national supply chain resilience for critical components.

Yes, the ongoing chip shortage is likely to continue impacting vehicle prices due to reduced supply and increased demand. Consumers may experience limited availability of certain models and potentially longer waiting periods for new cars throughout 2025.

Long-term solutions include investments in domestic manufacturing, technological innovations like software-defined vehicles to optimize chip usage, and enhanced supply chain visibility. These efforts aim to build a more resilient and adaptable automotive ecosystem.

What Happens Next – Strategic Implications for the Global Chip Crisis

The unfolding scenario around the 2025 global chip shortage will remain a defining challenge for the automotive sector, with manufacturers reassessing their long-term strategies to prevent future supply disruptions. As the global chip supply chain becomes a critical geopolitical asset, automotive leaders are shifting their focus from temporary fixes to structural resilience, prioritizing domestic semiconductor manufacturing capacity and diversified sourcing models.

In the coming months, industry observers expect new announcements regarding global chip fabrication plants in the United States, as well as expanded alliances between automakers and semiconductor firms designed to guarantee priority access to high-performance components. Analysts emphasize that global chip dependency has evolved into a national security and competitiveness issue, accelerating policy initiatives and investment incentives at the federal level.

Strategic insights from market intelligence sources, como o relatório da Deloitte Semiconductor Industry Outlook, indicam que os países que conseguirem fortalecer sua autonomia dentro da cadeia de global chip production garantirão uma vantagem estrutural na corrida por tecnologias automotivas avançadas. This shift marks a turning point, where control over global chip logistics and fabrication directly influences innovation cycles, cost structures, and market expansion.

Looking forward, the resilience of the automotive industry will depend on its ability to anticipate and integrate global chip strategies into core manufacturing philosophy. It is no longer just about weathering the shortage—it is about redefining the automotive ecosystem around global chip intelligence, supply sovereignty, and design adaptability. Those who lead this integration will not only protect their production capacity but will set the pace for the next generation of mobility technology.