2025 EV Supply Chain Crunch: Availability & Impact

The 2025 EV supply chain crunch is set to critically challenge electric vehicle availability over the next six months due to escalating raw material shortages and geopolitical complexities.

The automotive industry is bracing for a significant challenge as the 2025 EV Supply Chain Crunch: What It Means for Vehicle Availability in the Next 6 Months (TIME-SENSITIVE) looms large. This impending crisis threatens to reshape the electric vehicle market, impacting everything from production lines to showroom floors. Understanding the immediate and long-term implications is crucial for both manufacturers and consumers.

Understanding the Looming 2025 EV Supply Chain Crunch

The 2025 EV supply chain crunch is not a sudden event but rather the culmination of several escalating pressures. Industry analysts and manufacturers have been sounding the alarm for months, pointing to a confluence of factors that are now reaching critical mass. This crunch is expected to significantly affect the production and delivery of electric vehicles (EVs) globally, making the next six months a pivotal period for the automotive sector.

At its core, the crunch stems from an imbalance between surging demand for EVs and the constrained supply of essential components and raw materials. While consumer interest in electric vehicles continues to grow, the infrastructure and resource extraction necessary to meet this demand are struggling to keep pace. This creates a bottleneck that will inevitably lead to tightened availability and potentially higher prices for new EV models.

Key Drivers of the Shortage

Several interconnected issues are fueling this impending supply chain crisis. Each factor, while significant on its own, exacerbates the others, creating a complex web of challenges for manufacturers.

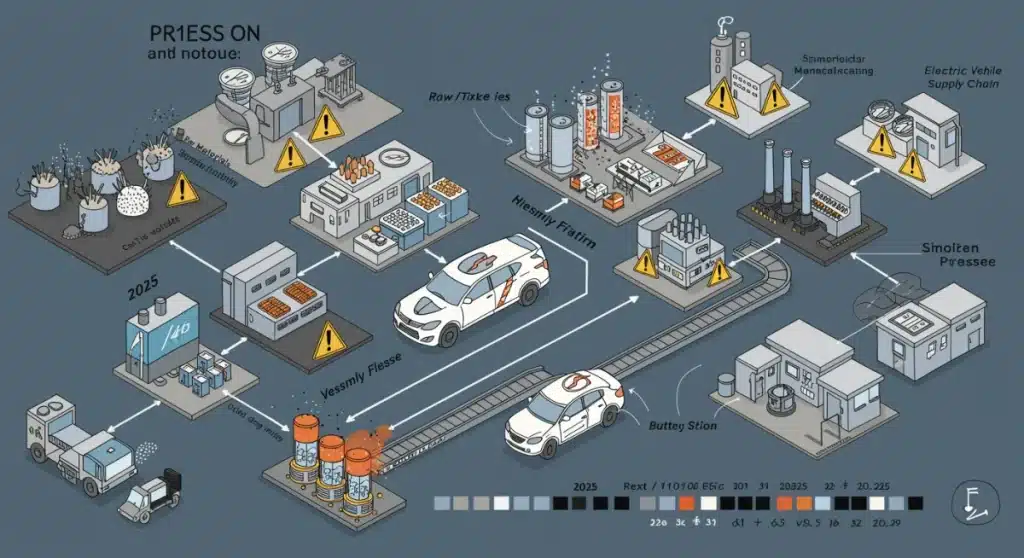

- Raw Material Scarcity: Critical minerals like lithium, cobalt, and nickel, essential for EV batteries, face increasing demand with limited new mining projects coming online.

- Geopolitical Tensions: Trade disputes and international relations impact the flow of goods and raw materials, particularly from regions central to mineral extraction and processing.

- Manufacturing Bottlenecks: Production capacity for battery cells, semiconductors, and other specialized EV components has not scaled rapidly enough to match vehicle assembly targets.

- Logistics and Shipping Issues: Ongoing global shipping disruptions, port congestion, and increased freight costs continue to add pressure to delivery timelines and overall supply chain efficiency.

Raw Material Constraints: The Foundation of the Problem

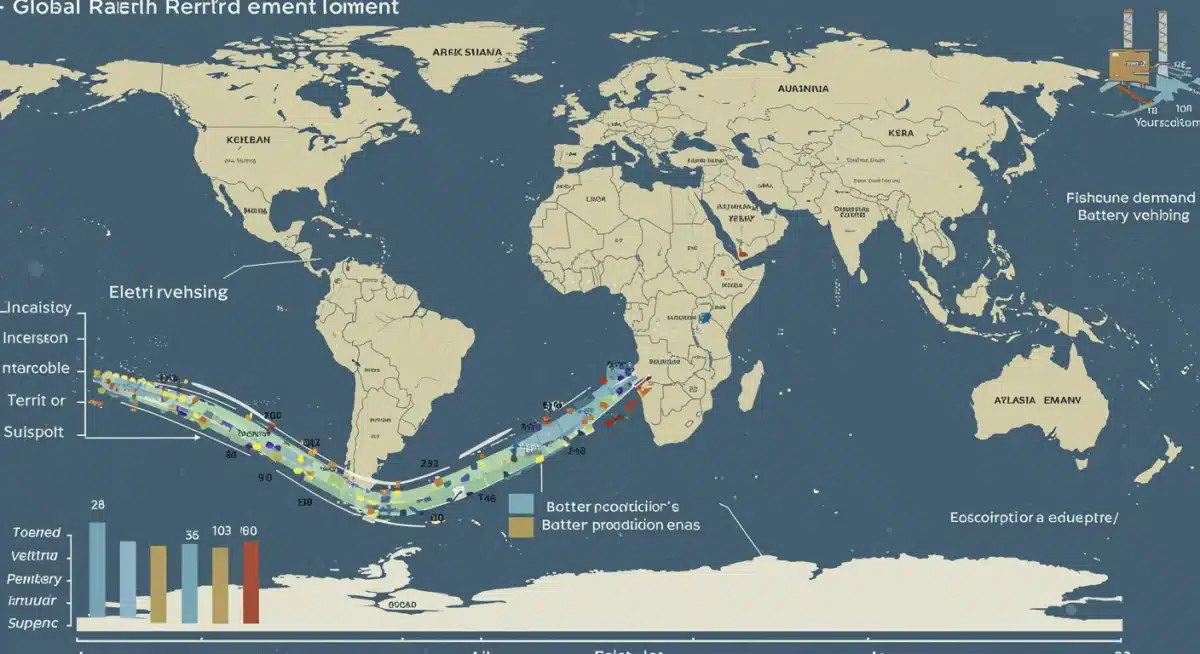

The backbone of any electric vehicle is its battery, and the production of these batteries is heavily reliant on a handful of key raw materials. As of early 2024, reports from various industry bodies, including the International Energy Agency (IEA), highlight a growing deficit in the supply of these critical minerals. This deficit is a primary driver behind the anticipated 2025 EV supply chain crunch.

Lithium, cobalt, and nickel are particularly vulnerable. While new deposits are being discovered, the lengthy process of establishing new mines, from exploration to full-scale production, can take a decade or more. This lag means that current and short-term supply is largely fixed, while EV production targets continue to climb aggressively worldwide. The dependency on a few dominant producing regions also introduces significant geopolitical risks.

<!– IMAGE_INTERNAL_1: A visual representation of global rare earth element mining and processing, with overlayed graphics showing increased demand and limited supply, impacting battery production for electric vehicles. Geopolitical maps and industrial sites could be subtly integrated. –>

The Lithium and Cobalt Conundrum

Lithium demand, projected to increase exponentially, is already straining existing mines. New extraction technologies and recycling efforts are underway but are not yet at a scale to offset the immediate shortfall. Cobalt, often a byproduct of copper and nickel mining, faces ethical sourcing concerns in some major producing regions, further complicating its supply chain.

- Lithium: Essential for cathodes in most EV batteries. Global demand outstrips current production capacity, leading to price volatility and supply insecurity.

- Cobalt: Provides stability and energy density to batteries. Its supply is concentrated in politically sensitive areas, raising ethical and logistical challenges.

- Nickel: Used to increase energy density and reduce cobalt content. While more abundant, high-purity nickel suitable for EV batteries is still a specialized commodity.

The push for alternative battery chemistries, such as sodium-ion or solid-state batteries, aims to reduce reliance on these critical materials. However, these technologies are still in various stages of research and development, with widespread commercial deployment still several years away. This means the pressure on traditional battery materials will persist well into the near future.

Semiconductors: A Persistent Bottleneck

While often associated with consumer electronics, semiconductors are indispensable components in modern vehicles, especially electric ones. EVs rely on hundreds, sometimes thousands, of chips to manage everything from battery performance and motor control to infotainment and advanced driver-assistance systems (ADAS). The semiconductor shortage that began in 2020 has eased somewhat but remains a significant factor contributing to the 2025 EV supply chain crunch.

Automakers learned valuable lessons from the initial chip crisis, leading to efforts to diversify suppliers and redesign vehicle architectures to use more readily available chips. However, the specialized nature of automotive-grade semiconductors, which require higher durability and longer lifecycles, means that capacity remains tight. The lead time for manufacturing these chips is extensive, making quick adjustments to supply extremely challenging.

Impact on EV Production Lines

A single missing chip can halt the production of an entire vehicle. This vulnerability means that even if all other raw materials and components are available, a lack of semiconductors can bring assembly lines to a standstill. This directly translates to fewer EVs reaching dealerships and consumers.

- Specialized Chips: EVs require high-power chips for motor control and battery management, which are distinct from those used in smartphones or PCs.

- Limited Foundries: A small number of foundries globally specialize in producing these automotive-grade semiconductors, creating a choke point in the supply chain.

- Supply Chain Transparency: Automakers are working to gain better visibility into their chip supply chains to anticipate and mitigate future disruptions.

The global push for increased domestic semiconductor manufacturing capacity, particularly in the United States and Europe, is a long-term strategy to address this vulnerability. Yet, these new fabs will not be fully operational and producing at scale for several years, meaning the current constraints will likely persist through 2025 and beyond.

Geopolitical Factors and Trade Policies

The global nature of the EV supply chain makes it inherently susceptible to geopolitical shifts and trade policies. The extraction of critical minerals, their processing, and the manufacturing of components are often concentrated in specific countries or regions. Any disruption, whether from political tensions, trade tariffs, or even natural disasters, can have a cascading effect across the entire industry.

For instance, China currently dominates the processing of many critical EV battery minerals, regardless of where they are mined. This concentration creates a single point of failure and makes the supply chain vulnerable to changes in trade relations. Western nations are actively working to de-risk their supply chains by fostering domestic processing capabilities and diversifying sources, but these are long-term strategies.

How Policies Influence Availability

Government policies, including subsidies for EV adoption and local manufacturing incentives, also play a significant role. While these policies aim to accelerate the transition to electric vehicles, they can also inadvertently strain supply chains by rapidly increasing demand without a proportional increase in component supply.

- Export Restrictions: Countries with dominant control over raw materials could impose export restrictions, limiting global supply.

- Trade Tariffs: Tariffs on imported components or finished EVs can increase costs and reduce accessibility for consumers.

- Environmental Regulations: Stricter environmental regulations in mining or processing regions can slow down production or increase operational costs, impacting overall supply.

The ongoing conflict in Eastern Europe and tensions in other key geopolitical hotspots further complicate the picture. These events can disrupt shipping routes, increase energy costs, and divert resources, all of which indirectly contribute to the fragility of the EV supply chain.

Impact on Vehicle Availability and Pricing: Next 6 Months

The immediate consequence of the 2025 EV supply chain crunch will be felt directly by consumers in the form of reduced vehicle availability and potentially higher prices over the next six months. Automakers are already grappling with extended delivery times for many popular EV models, and this situation is expected to intensify.

New EV launches might face delays, and production targets could be scaled back. This scenario creates a seller’s market, where demand continues to outstrip supply, giving manufacturers less incentive to offer significant discounts. For consumers, this means longer waiting lists, fewer options on dealership lots, and a higher likelihood of paying close to, or even above, the manufacturer’s suggested retail price (MSRP).

Consumer Outlook and Market Dynamics

The time-sensitive nature of this crunch means that decisions made now by manufacturers and policymakers will have direct consequences for vehicle availability in the very near future. Consumers looking to purchase an EV in the coming months should prepare for potential challenges.

- Longer Waiting Lists: Popular models are likely to see increased lead times for delivery.

- Limited Model Choices: Specific configurations or trim levels may be harder to find due to component shortages.

- Potential Price Increases: Raw material and component cost increases are often passed on to the consumer.

- Used EV Market Shift: A constrained new EV market could drive up demand and prices for used electric vehicles.

Automakers are attempting to prioritize production for their most profitable models or those with the highest demand. This strategic allocation can further limit options for entry-level or less popular EV segments. The market dynamics are fluid, but the underlying trend points towards a period of tight supply.

Mitigation Strategies and Future Outlook

In response to the impending 2025 EV supply chain crunch, both governments and automotive manufacturers are implementing various mitigation strategies. These efforts aim to alleviate the immediate pressures and build a more resilient supply chain for the long term. However, the effectiveness of these measures in the next six months will be limited due to the time required for major infrastructure and policy changes to take effect.

Manufacturers are focusing on diversifying their supplier base, investing in vertical integration, and redesigning products to use more common components. Governments are supporting domestic mining and processing initiatives, as well as fostering international partnerships to secure critical resources. Recycling of battery materials is also gaining traction as a way to reduce reliance on newly mined resources.

Building Resilience for Tomorrow

While the immediate outlook for EV availability is challenging, these long-term strategies offer hope for a more stable future. The industry is rapidly adapting, but the scale of the transition to electric vehicles means that growing pains are inevitable.

- Diversification: Spreading supply contracts across multiple regions and suppliers to reduce dependency.

- Recycling Initiatives: Developing robust systems for recovering and reusing critical battery materials from end-of-life EVs.

- Technological Innovation: Investing in new battery chemistries that use less scarce materials or offer higher energy density.

- Government Support: Policies and funding to boost domestic production of raw materials, components, and finished EVs.

The next six months will be a test of how well these proactive measures can cushion the impact of the crunch. While significant improvements in supply chain resilience will take time, the foundation for a more robust EV ecosystem is actively being laid.

| Key Point | Brief Description |

|---|---|

| Raw Material Scarcity | Limited global supply of lithium, cobalt, and nickel is directly impacting battery production for EVs. |

| Semiconductor Shortage | Persistent lack of specialized chips continues to hinder EV manufacturing and assembly lines. |

| Geopolitical Impact | Trade policies and international tensions affect the flow and cost of critical EV components. |

| Vehicle Availability | Consumers can expect longer waiting times and potentially higher prices for new EVs over the next six months. |

Frequently Asked Questions About the EV Supply Crunch

The primary cause is the severe imbalance between rapidly increasing global demand for electric vehicles and the constrained supply of critical raw materials like lithium, cobalt, and nickel, coupled with persistent semiconductor shortages and geopolitical factors.

Over the next six months, consumers can expect longer waiting lists for popular EV models, fewer configuration options, and potential price increases due to heightened demand and limited supply. Dealership inventories will likely remain tight.

Yes, manufacturers are actively diversifying suppliers, investing in domestic raw material processing, and exploring new battery technologies. They are also redesigning vehicles to optimize component usage, though these are largely long-term solutions.

While the broader semiconductor shortage has eased, specialized automotive-grade chips remain a bottleneck. The long lead times for manufacturing these robust chips mean they will continue to impact EV production through 2025.

Consumers planning an EV purchase should place orders early, be flexible with models and features, and consider exploring the used EV market. Staying informed about inventory updates from local dealerships is also advisable.

What This Means

The unfolding 2025 EV supply chain crunch signals a critical period for the electric vehicle industry and consumers alike. The next six months will serve as a bellwether, revealing the true extent of these supply constraints on global markets. We anticipate continued volatility in raw material prices and ongoing pressure on manufacturing timelines. Industry stakeholders will closely monitor geopolitical developments and the efficacy of newly implemented mitigation strategies. This period will undoubtedly shape future investment in mining, processing, and battery production, driving innovation towards more resilient and localized supply chains. Consumers should remain informed and prepared for a dynamic market environment as the transition to electric mobility accelerates.