Semiconductor Shortage: New Car Deliveries in US by Mid-2025

The latest semiconductor shortage is projected to significantly impact new car deliveries in the US through mid-2025, leading to substantial financial repercussions for both the automotive industry and consumers.

How the Latest Semiconductor Shortage Will Affect New Car Deliveries in the US by Mid-2025 (FINANCIAL IMPACT) is a critical concern for the automotive sector and consumers across the United States. This ongoing crisis continues to reshape market dynamics, production forecasts, and the financial landscape for new vehicle purchases.

Understanding the Persistent Semiconductor Shortage

The semiconductor chip shortage, initially triggered by pandemic-related disruptions and amplified by surging demand for electronics, has become a stubborn fixture in the automotive industry. These tiny components are essential for everything from engine management and infotainment systems to advanced safety features, making vehicle production impossible without them.

As of early 2024, the industry faces a complex web of challenges, including geopolitical tensions, raw material constraints, and the inherent lead times in semiconductor manufacturing. Forecasts suggest that while some improvements may be seen, a full resolution enabling pre-shortage production levels will not materialize before mid-2025.

Root Causes of the Prolonged Shortage

- Pandemic-Induced Disruptions: Initial factory shutdowns and shifts in consumer spending towards electronics diverted chip production away from automotive.

- Geopolitical Factors: Trade tensions and regional conflicts have impacted supply chains and increased uncertainty for chip manufacturers.

- Increased Demand for Advanced Features: Modern vehicles require a greater number and more sophisticated types of semiconductors, intensifying demand.

- Limited Manufacturing Capacity: Building new chip fabrication plants (fabs) is incredibly expensive and takes several years, meaning supply cannot quickly catch up to demand.

The confluence of these factors has created a persistent bottleneck, directly translating into fewer vehicles rolling off assembly lines and reaching dealership lots. This situation has significant implications for how the semiconductor shortage car deliveries will unfold over the next year.

Direct Impact on New Car Deliveries in the US

The most immediate and visible consequence of the semiconductor shortage is the drastic reduction in new car deliveries. Dealerships nationwide are experiencing historically low inventory levels, leading to longer waiting times for popular models and limited choices for buyers. This scarcity directly affects the automotive market’s ability to meet consumer demand.

Automakers have been forced to prioritize production of their most profitable models, often higher-trim SUVs and trucks, leaving entry-level and compact segments with even fewer options. This strategic shift, while mitigating some financial losses for manufacturers, further exacerbates the delivery challenges for a broader range of consumers. The ripple effect extends beyond mere availability, influencing consumer behavior and purchasing decisions significantly.

Key Statistics and Projections

- Reduced Production: Industry analysts, including S&P Global Mobility, estimate millions of units of lost vehicle production globally since the shortage began, with significant portions affecting the US market.

- Inventory Levels: New car inventory levels in the US remain well below pre-pandemic averages, often hovering at less than 30-40 days’ supply compared to a healthy 60-70 days.

- Longer Wait Times: Consumers are routinely facing wait times of several months, and in some cases over a year, for specific models or configurations.

The ongoing struggle to secure adequate chip supplies means that manufacturers cannot simply ramp up production overnight. This protracted constraint ensures that the issue of semiconductor shortage car deliveries will continue to define the market through at least the first half of 2025, impacting both supply and consumer experience.

Financial Implications for Consumers

For consumers, the semiconductor shortage translates into a challenging and often more expensive car-buying experience. The basic economic principle of supply and demand is in full effect: fewer cars available mean higher prices. This financial impact is multifaceted, affecting not only the purchase price but also financing, insurance, and even the used car market.

Many buyers are finding that negotiation power is severely diminished, with vehicles often selling at or above the Manufacturer’s Suggested Retail Price (MSRP). This trend is a stark departure from pre-shortage conditions where discounts were common. Furthermore, the limited availability of new cars has driven up demand and prices in the used car market, creating a domino effect across the entire automotive ecosystem.

Rising Costs and Limited Options

- Higher Transaction Prices: Average transaction prices for new vehicles have reached record highs, with many buyers paying over MSRP.

- Reduced Incentives: Automakers and dealerships have significantly cut back on promotional offers, rebates, and low-interest financing deals.

- Impact on Used Car Market: The scarcity of new cars has pushed up demand and prices for used vehicles, making it harder for consumers to find affordable alternatives.

- Increased Financing Costs: Higher vehicle prices often lead to larger loan amounts and, potentially, higher monthly payments despite stable interest rates.

These financial pressures mean that purchasing a new car today requires a larger budget and more patience than in previous years. The semiconductor shortage car deliveries directly contribute to this inflationary environment within the automotive sector, making affordability a significant hurdle for many American households.

Financial Impact on the Automotive Industry

The automotive industry is grappling with immense financial strain due to the semiconductor shortage. While some manufacturers have managed to maintain profitability by prioritizing high-margin vehicles, the overall picture is one of lost revenue, increased costs, and significant operational challenges. Billions of dollars in potential sales have been forfeited globally, and this trend is expected to continue.

Beyond lost sales, automakers face increased costs for securing scarce chips, often resorting to spot markets or paying premiums. Production schedules are constantly in flux, leading to inefficiencies, increased logistics expenses, and challenges in managing their workforce. The shortage also compels significant investment in redesigning supply chains and increasing chip sourcing resilience, incurring substantial capital expenditure.

Revenue Losses and Operational Challenges

- Lost Production and Sales: Major automakers have reported significant revenue shortfalls directly attributable to unbuilt vehicles.

- Increased Supply Chain Costs: Expedited shipping, premium chip pricing, and supply chain reconfigurations add to operational expenses.

- Investment in Resilience: Companies are investing heavily in long-term strategies, such as direct partnerships with chip manufacturers and vertical integration, to prevent future disruptions.

The financial health of many automotive suppliers, particularly smaller ones, is also under pressure as production cuts ripple down the supply chain. The need to adapt to this new normal is driving strategic shifts across the industry, highlighting the profound and lasting financial consequences of the semiconductor shortage car deliveries crisis.

Strategies for Mitigation and Long-Term Solutions

In response to the prolonged semiconductor shortage, the automotive industry and governments are implementing various strategies aimed at mitigating the current impact and building long-term resilience. These efforts range from immediate operational adjustments to significant policy interventions and strategic investments.

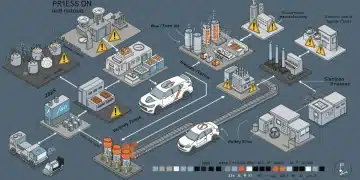

Automakers are actively redesigning components to use more readily available chips, dual-sourcing critical parts, and forging direct, long-term relationships with semiconductor manufacturers. Governments, particularly in the US, are pushing for increased domestic chip manufacturing through initiatives like the CHIPS and Science Act, aiming to reduce reliance on overseas production and stabilize future supply.

Industry and Government Responses

- Supply Chain Diversification: Automakers are diversifying their chip suppliers and seeking alternatives to single-source components.

- Chip Redesign: Engineering teams are optimizing vehicle designs to use a wider range of chips or fewer chips where possible.

- Government Incentives: The US CHIPS Act provides significant funding to boost domestic semiconductor production and research.

- Increased Inventory Holding: Some companies are building buffer inventories of critical components to withstand future disruptions.

While these strategies offer hope for future stability, their full effects will take time to materialize. The construction of new fabs can take years, meaning that relief for the current semiconductor shortage car deliveries issue will be gradual, extending well into 2025 and beyond. The focus remains on building a more robust and resilient supply chain.

Outlook for New Car Deliveries through Mid-2025

Looking ahead to mid-2025, the consensus among industry experts is that while the intensity of the semiconductor shortage may slightly ease, significant improvements in new car deliveries will likely remain elusive. The automotive sector will continue to operate under constrained conditions, characterized by below-average inventory levels and extended lead times for many models.

The transition to a more stable supply environment is not a flip of a switch but a gradual process. Factors such as continued strong demand for vehicles, the increasing complexity of automotive technology, and the inherent time lags in semiconductor production capacity expansion mean that a return to pre-shortage market conditions is not anticipated within this timeframe. Consumers should prepare for a market that still favors sellers, with limited discounts and potential for continued price inflation.

Key Forecasts and Expectations

- Gradual Improvement, Not Full Recovery: Modest increases in chip supply are expected, but insufficient to fully meet pent-up demand.

- Continued Price Pressure: High demand and limited supply will likely keep new vehicle prices elevated.

- Focus on High-Margin Vehicles: Automakers will continue to prioritize production of high-profit models, impacting availability of other segments.

- Used Car Market Stability: While new car supply remains tight, the used car market will likely continue to see elevated demand and prices.

The outlook for semiconductor shortage car deliveries through mid-2025 indicates a persistent challenge for both the industry and consumers. While efforts to bolster supply chains are underway, their impact will be felt more significantly in the latter half of 2025 and beyond. Patience and adaptability will remain key for those looking to purchase a new vehicle.

| Key Aspect | Impact by Mid-2025 > |

|---|---|

| New Car Availability | Limited inventory, longer wait times for many models. |

| Consumer Costs | Elevated prices, fewer discounts, higher used car values. |

| Industry Production | Continued production cuts, prioritization of high-margin vehicles. |

| Supply Chain Resilience | Ongoing efforts to diversify sourcing, build domestic capacity. |

Frequently Asked Questions About Car Delivery Delays

The shortage persists due to a combination of factors, including the long lead times for chip manufacturing, increased demand for advanced automotive features, and ongoing geopolitical disruptions affecting global supply chains. Building new fabrication plants takes years, delaying significant relief.

Buyers will likely face higher transaction prices, continued limited availability of discounts and incentives, and longer waiting periods for new vehicles. The scarcity also drives up prices in the used car market, affecting overall affordability.

While all segments are impacted, automakers often prioritize higher-margin vehicles like SUVs, trucks, and luxury models. This means that more affordable, entry-level cars may experience even greater scarcity and longer delivery delays for consumers.

Automakers are redesigning vehicles to use more common chips, diversifying their supplier base, and forming direct partnerships with chip manufacturers. Many are also investing in long-term supply chain resilience to mitigate future disruptions and secure critical components.

While some gradual improvements are anticipated, a full return to pre-shortage inventory levels and delivery times is not expected before mid-2025, possibly extending into 2026. The market will likely remain constrained for the foreseeable future.

Looking Ahead: The Evolving Automotive Landscape

The persistent semiconductor shortage is no longer seen as a short-term disruption but as a catalyst for a deeper structural transformation in the global automotive ecosystem. As the industry moves into mid-2025, strategic focus is shifting away from reactive crisis containment toward long-term capacity building, workforce specialization, and semiconductor sovereignty. Automakers are reassessing their operating models, prioritizing direct partnerships with chip manufacturers and exploring co-investment in fabrication facilities to secure production continuity.

Consumers can expect a market where vehicle acquisition becomes more strategic, with extended delivery timelines, fluctuating pricing, and growing differentiation between brands that secured semiconductor access early and those still dependent on volatile supply chains. This new era introduces a competitive divide based on supply chain intelligence and semiconductor integration capabilities, rather than traditional metrics like engine performance or design innovation.

Industry observers highlight that talent development in semiconductor engineering is now as critical as physical manufacturing infrastructure. Reports such as the one by FinancialContent on the emerging workforce gap reveal that building a future-ready semiconductor workforce has become a bottleneck that could define which countries and companies will rise as leaders in the next automotive cycle. Without skilled engineers, material scientists, and advanced fabrication specialists, even large investments in domestic chip plants may fall short of their intended impact.

Looking forward, the automotive sector’s resilience will depend on its ability to combine semiconductor supply security, human capital development, and strategic technological independence. The next chapter of this transition will not be written in boardrooms alone, but in training centers, R&D labs, and localized high-tech manufacturing hubs across North America, Europe, and Asia. Those who align technology, talent, and supply chain foresight will dictate the pace of innovation and reshape the future of mobility for an entire generation.