US Auto Production: Q1 2025 Supply Chain Shifts

The 3 Critical Supply Chain Shifts Impacting US Auto Production in Q1 2025 (INSIDER KNOWLEDGE) are poised to redefine industry standards, focusing on semiconductor resilience, advanced logistics, and sustainable raw material sourcing.

As Q1 2025 approaches, the US automotive sector is bracing for significant transformations. The 3 Critical Supply Chain Shifts Impacting US Auto Production in Q1 2025 (INSIDER KNOWLEDGE) are not merely adjustments; they represent a fundamental re-evaluation of how vehicles are made and delivered. This report delves into the core changes, offering a clear, factual analysis of what to expect and why these shifts are crucial for the industry’s future.

The Semiconductor Sourcing Revolution: Diversification and Domestic Focus

The lessons learned from recent global chip shortages have propelled a decisive move towards diversifying semiconductor supply chains. Automakers and suppliers are actively seeking to mitigate future disruptions by reducing reliance on single geographic regions and investing in new production capabilities.

This strategic pivot involves both expanding the pool of international suppliers and, critically, fostering a stronger domestic semiconductor manufacturing base. The goal is not just to secure supply but to build resilience into the very foundation of automotive electronics, ensuring consistent production flow.

Geopolitical Influences and Trade Policies

Geopolitical tensions and evolving trade policies are directly influencing where and how semiconductors are sourced. Governments are providing incentives for local production, aiming to reduce strategic vulnerabilities. This has led to a re-evaluation of existing supply contracts and a push towards more regionally balanced sourcing models.

- Increased Domestic Investment: New fabs and foundries are being planned and constructed within the U.S., supported by federal initiatives like the CHIPS Act.

- Regional Hub Development: Efforts are underway to create robust semiconductor ecosystems in North America, minimizing dependence on distant manufacturing centers.

- Supplier Vetting: Enhanced due diligence on international suppliers focuses on long-term stability and compliance with evolving trade regulations.

The shift is complex, requiring substantial capital investment and time to build out new infrastructure. However, the industry consensus is that the long-term benefits of a more secure and diversified semiconductor supply outweigh the immediate challenges.

Adaptive Logistics and Inventory Management: Speed, Efficiency, and Resilience

The traditional “just-in-time” inventory model, while efficient, proved vulnerable during periods of extreme disruption. In response, the automotive industry is adopting more adaptive and resilient logistics strategies, combining lean principles with strategic buffer stocks and advanced digital tools.

This evolution is about optimizing the flow of goods, not just minimizing inventory. It integrates predictive analytics, real-time tracking, and automated warehousing to create a more responsive and robust supply chain capable of absorbing shocks and adapting quickly to changing market demands.

Embracing Digital Transformation in Logistics

Digital technologies are at the forefront of this logistical overhaul. Blockchain for transparency, AI for demand forecasting, and IoT for real-time asset tracking are becoming standard tools. These technologies provide unprecedented visibility across the entire supply chain, enabling proactive decision-making and rapid problem-solving.

- Real-time Visibility: Advanced tracking systems provide granular data on component location and status, from raw material extraction to factory floor delivery.

- Predictive Analytics: AI-driven models forecast potential disruptions, allowing companies to reroute shipments or adjust production schedules before problems escalate.

- Automated Warehousing: Robotics and automation are streamlining warehouse operations, improving speed, accuracy, and reducing labor costs.

The goal is to move towards a “just-in-case” mentality for critical components while maintaining efficiency for less volatile items. This hybrid approach aims to strike a balance between cost optimization and supply chain resilience, a critical component of The 3 Critical Supply Chain Shifts Impacting US Auto Production in Q1 2025 (INSIDER KNOWLEDGE).

![]()

Raw Material Availability and Sustainable Sourcing: The Green Imperative

The automotive industry’s push towards electric vehicles (EVs) and sustainable manufacturing has intensified the focus on raw material sourcing. Critical minerals like lithium, cobalt, and nickel are in high demand, leading to increased scrutiny over their availability, extraction practices, and geopolitical implications.

This shift encompasses not only securing consistent access to these materials but also ensuring they are sourced ethically and sustainably. Companies are investing in closed-loop recycling systems, exploring alternative materials, and establishing transparent supply chains to meet both environmental regulations and consumer expectations.

Ethical Sourcing and Environmental Compliance

The demand for ethically sourced materials is growing, driven by regulatory pressures and corporate social responsibility initiatives. Automakers are implementing stringent due diligence processes to ensure their supply chains are free from human rights abuses and environmentally damaging practices. This includes tracing materials back to their origin and working with certified suppliers.

Furthermore, the industry is exploring innovative ways to reduce its reliance on newly mined materials. Investments in battery recycling facilities and research into solid-state batteries are key components of this long-term strategy, aiming to create a more circular economy within automotive manufacturing.

The drive for sustainable sourcing is not just about compliance; it’s about building a more resilient and responsible supply chain that aligns with global environmental goals. This includes exploring new mining techniques, developing synthetic alternatives, and fostering international collaborations to ensure a stable and ethical supply of essential raw materials for future vehicle production. These efforts are central to understanding The 3 Critical Supply Chain Shifts Impacting US Auto Production in Q1 2025 (INSIDER KNOWLEDGE).

Impact of Advanced Manufacturing Technologies on Production

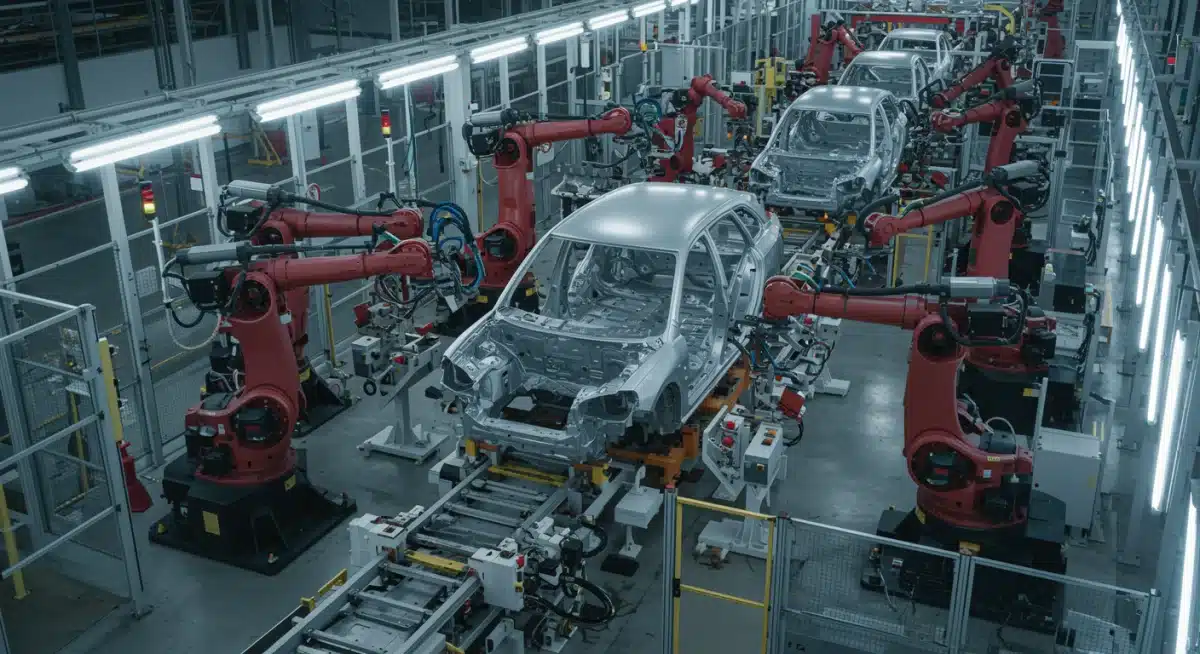

Beyond the core supply chain elements, advanced manufacturing technologies are playing an increasingly crucial role in defining US auto production. Automation, artificial intelligence, and additive manufacturing are transforming factory floors, making production processes more efficient, flexible, and capable of handling complex demands. This integration of technology directly impacts the efficiency of the supply chain, reducing waste and speeding up assembly times.

The adoption of these technologies is not uniform across the industry, but leaders are demonstrating significant gains in productivity and quality. This technological leap allows for greater customization and a quicker response to market shifts, positioning manufacturers to better navigate the evolving supply landscape.

Robotics and Automation in Assembly

Robotics continue to advance, moving beyond simple repetitive tasks to more complex, collaborative roles alongside human workers. This enhances precision, reduces labor costs, and improves safety. AI-driven systems optimize production schedules and identify potential bottlenecks before they occur, ensuring a smoother flow of components from the warehouse to the assembly line.

- Enhanced Precision: Robotic arms deliver consistent quality and accuracy in assembly, particularly for intricate tasks.

- Increased Speed: Automated processes significantly reduce the time required for various stages of vehicle production.

- Worker Safety: Robots handle hazardous or ergonomically challenging tasks, improving workplace safety for human employees.

The integration of these technologies is critical for maintaining competitiveness and adapting to the rapid pace of innovation in the automotive sector. It also supports the broader goals of supply chain resilience by enabling more localized and agile manufacturing operations.

Policy and Regulatory Landscape: Shaping Future Supply Chains

Government policies and regulations are exerting a profound influence on the direction of automotive supply chains. From trade agreements and tariffs to environmental mandates and domestic content requirements, the legislative environment is a critical factor dictating procurement strategies and manufacturing locations. Understanding these policies is essential for any company navigating The 3 Critical Supply Chain Shifts Impacting US Auto Production in Q1 2025 (INSIDER KNOWLEDGE).

For Q1 2025, particular attention is being paid to policies that encourage reshoring or nearshoring of production, as well as those that promote sustainable practices and critical mineral development. These regulatory frameworks are designed to bolster national economic security and environmental stewardship, directly impacting how automakers structure their global operations.

Government Incentives and Trade Agreements

Various government incentives, such as tax credits and grants, are designed to stimulate investment in domestic manufacturing and critical infrastructure. These programs aim to reduce reliance on foreign suppliers and create a more self-sufficient automotive industry within the U.S. Trade agreements also play a significant role, influencing the cost and feasibility of importing components versus producing them domestically.

- Reshoring Initiatives: Policies actively promote bringing manufacturing operations back to the U.S. or to allied nations.

- Environmental Regulations: Stricter emissions standards and recycling mandates drive innovation in materials and production processes.

- Critical Mineral Policies: Efforts to secure domestic supplies of minerals vital for EV batteries are shaping new mining and processing projects.

The dynamic nature of these policies requires continuous monitoring and adaptation from automotive companies. Compliance with evolving regulations is not just a legal necessity but a strategic imperative for long-term viability and growth in the US market.

Collaboration and Partnerships: Strengthening the Ecosystem

The complexity of modern automotive supply chains necessitates unprecedented levels of collaboration. Automakers are increasingly forging deeper partnerships with their suppliers, technology providers, and even competitors to navigate the challenges and capitalize on opportunities presented by these shifts. This collaborative approach is a cornerstone of successfully implementing The 3 Critical Supply Chain Shifts Impacting US Auto Production in Q1 2025 (INSIDER KNOWLEDGE).

These partnerships extend beyond traditional buyer-supplier relationships, encompassing joint ventures in research and development, shared investment in new technologies, and coordinated efforts to address industry-wide issues such as cybersecurity and talent development. The aim is to create a more integrated and resilient ecosystem capable of collective problem-solving.

Strategic Alliances for Innovation

Strategic alliances are particularly vital in areas of rapid technological advancement, such as battery technology and autonomous driving systems. By pooling resources and expertise, companies can accelerate innovation, share risks, and bring new solutions to market more quickly. These collaborations often involve cross-industry partners, including tech giants and energy companies, reflecting the increasingly interdisciplinary nature of the automotive sector.

- Joint R&D: Collaborations on next-generation materials, software, and manufacturing processes accelerate innovation cycles.

- Information Sharing: Enhanced communication channels between partners improve transparency and responsiveness across the supply chain.

- Talent Development: Joint initiatives address the growing demand for skilled labor in new automotive technologies.

The future success of US auto production hinges on the ability of its various stakeholders to work together effectively. These partnerships foster a shared sense of responsibility and a collective commitment to overcoming supply chain vulnerabilities and driving sustainable growth.

Key Shift |

Brief Description |

|---|---|

Semiconductor Diversification |

Reducing reliance on single regions through expanded global and domestic sourcing. |

Adaptive Logistics |

Implementing digital tools and hybrid inventory models for greater resilience and efficiency. |

Sustainable Raw Materials |

Securing ethical and environmentally responsible sourcing of critical minerals for EV production. |

Advanced Manufacturing |

Integrating automation and AI to enhance production flexibility and responsiveness. |

Frequently Asked Questions About US Auto Supply Chain Shifts

The shifts are primarily driven by past disruptions like chip shortages, geopolitical tensions affecting trade, the accelerating transition to electric vehicles, and a growing emphasis on sustainability and ethical sourcing across the industry.

Increased domestic semiconductor production will reduce reliance on foreign suppliers, enhance supply chain stability, and potentially shorten lead times for critical components. This fosters greater resilience against future global disruptions and supports economic growth.

Sustainable sourcing is crucial for securing critical EV battery materials ethically and environmentally responsibly. It helps meet regulatory demands, consumer expectations, and reduces long-term supply risks associated with unsustainable practices, ensuring industry longevity.

Initially, investments in new infrastructure and more resilient supply chains might lead to some cost increases. However, long-term benefits like reduced disruption risks and improved efficiency could stabilize or even lower costs over time, benefiting consumers.

Small and medium-sized suppliers need to adapt to new requirements for technology adoption, sustainability, and transparency. Collaboration with larger partners and access to government support programs will be crucial for their integration into these evolving supply chains.

Outlook and Implications

The proactive embrace of The 3 Critical Supply Chain Shifts Impacting US Auto Production in Q1 2025 (INSIDER KNOWLEDGE) signals a mature response to past vulnerabilities and a forward-looking strategy for sustained growth. These changes are not isolated events but interconnected efforts to build a more robust, agile, and ethical automotive future. Stakeholders should monitor policy developments, technological advancements, and the evolving landscape of global trade as these shifts continue to unfold and redefine the industry’s operational backbone.